Unit 9 - The Management of Fiat Currency

Learning Objective: Understand and be able to explain who manages fiat currency and how they manage it.

Unit Outline

9.1 The Management of Fiat Currency

9.2 The Federal Reserve System Functions

9.3 Members of the Federal Reserve Board

9.4 Who owns The Federal Reserve

9.5 The Federal Reserve’s Dual Mandate

9.6 How Well is The Fed Doing with its Other Responsibilties?

9.7 The Federal Reserve and Monetary Policy

9.8 The Federal Open Market Committee (FOMC)

9.1 The Management of Fiat Currency

The Federal Reserve manages the U.S. fiat currency regime. “The Federal Reserve System, often referred to as the Federal Reserve or simply “the Fed,” is the central bank of the United States. It was created by the Congress with the hope of providing the nation with a safer, more flexible, and more stable monetary and financial system. The Federal Reserve Act was signed into law on December 23, 1913.” (https://www.federalreserve.gov/faqs/about_12594.htm)

The most important price in any economic system is the price of money. As discussed previously, in a free market economy, the price of money is, like all other products, set by market forces. Conversely, in a planned/socialist economic system, the price of money is determined by central planners who meet in committees independent of market participants to fix prices.

9.2 The Federal Reserve System Functions

The Federal Reserve performs the following functions:

- Conducts the nation’s monetary policy by influencing money and credit conditions in the economy in pursuit of full employment and stable prices.

- Supervises and regulates banks and other important financial institutions to ensure the safety and soundness of the nation’s banking and financial system and protects the credit rights of consumers.

- Maintains the stability of the financial system and contains systemic risk that may arise in financial markets.

- Provides certain financial services to the U.S. government, U.S. financial institutions, and foreign official institutions, and plays a major role in operating and overseeing the nation’s payments systems.

(https://www.federalreserve.gov/faqs/about_12594.htm)

“The Federal Reserve acts as a central prudential authority, controlling the nation’s supply of money and credit and serving as lender of last resort to bail out over-leveraged, insolvent, and otherwise at-risk financial institutions.” (https://www.investopedia.com/terms/f/1913-federal-reserve-act.asp)

9.3 Members of the Federal Reserve Board

“The seven members of the Board of Governors of the Federal Reserve System are nominated by the President and confirmed by the Senate. A full term is fourteen years. One term begins every two years, on February 1 of even-numbered years. A member who serves a full term may not be reappointed. A member who completes an unexpired portion of a term may be reappointed. All terms end on their statutory date regardless of the date on which the member is sworn into office.

The Chair and the Vice Chair of the Board, as well as the Vice Chair for Supervision, are nominated by the President from among the members and are confirmed by the Senate. They serve a term of four years. A member’s term on the Board is not affected by his or her status as Chair or Vice Chair.” https://www.federalreserve.gov/aboutthefed/bios/board/default.htm

The current chair is Jerome Powell. He was born in February 1953 in Washington, D.C. He received an AB in politics from Princeton University in 1975 and earned a law degree from Georgetown University in 1979. From 1997 through 2005, Mr. Powell was a partner at The Carlyle Group–a multinational private equity, alternative asset management, and financial services company. Mr. Powell also served as an Assistant Secretary and as Under Secretary of the U.S. Department of the Treasury under President George H.W. Bush, with responsibility for policy on financial institutions, the Treasury debt market, and related areas. https://www.federalreserve.gov/aboutthefed/bios/board/powell.htm

9.4 Who owns The Federal Reserve

“The Federal Reserve Banks are not a part of the federal government, but they exist because of an act of Congress. Their purpose is to serve the public. So is the Fed private or public?

The answer is both. While the Board of Governors is an independent government agency, the Federal Reserve Banks are set up like private corporations. Member banks hold stock in the Federal Reserve Banks and earn dividends.”

(https://www.stlouisfed.org/in-plain-english/who-owns-the-federal-reserve-banks)

9.5 The Federal Reserve’s Dual Mandate

In addition to providing the fuctions listed above, the Fed has been given two mandates:

- Price stability

- Maximum sustainable employment

(https://www.chicagofed.org/research/dual-mandate/dual-mandate)

How well is the Fed doing with these two mandates?

As discussed previously, the Fed’s inflation target is 2%. At 2%, how long does it take for prices to double? You can use the Rule of 72 for this calculation. This rule states that you divide 72 by the interest rate so at 2% inflation, prices will double in 36 years:

72 / 2 = 36 years

What if interest rates are 5%?

72 / 5 = 14.4 years

How high is inflation?

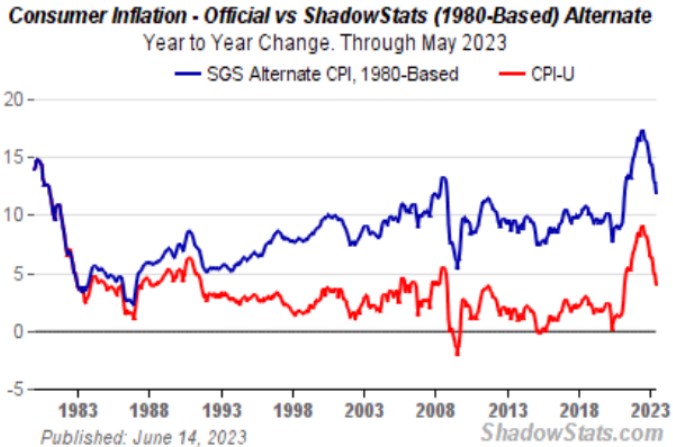

According to the Bureau of Labor Statistics (BLS), the Consumer Price Index (CPI) is around 6%. Interestingly, the BLS CPI doesn’t include food or energy. If you calculate the CPI using the formula used in the 80’s, as done by John Williams of Shadowstats.com, the CPI is closer to 12%:

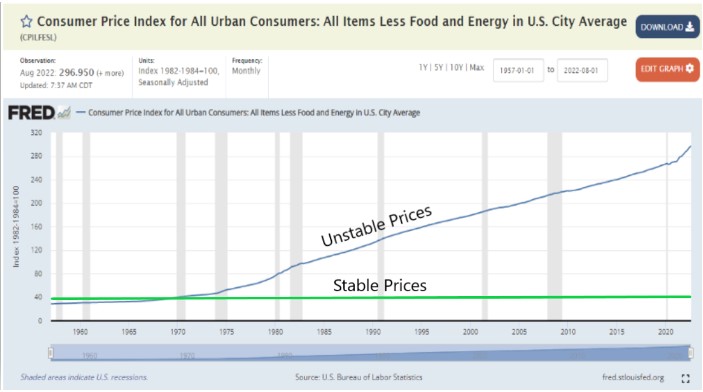

Are prices stable (definition: not changing or fluctuating) or unstable (changing or fluctuating)?

How high is unemployment?

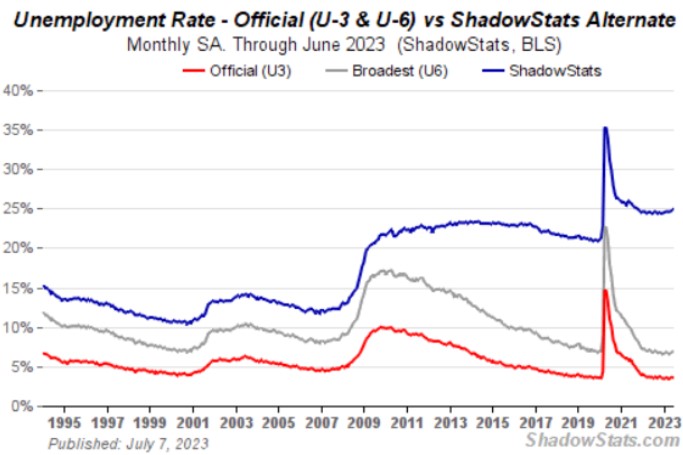

According to the Bureau of Labor Statistics (BLS), the Unemployment rate is around 4%. Interestingly, the government’s unemployment rate doesn’t include all the unemployed people. If you are unemployed but you have given up on looking for a job, you’re not unemployed. Go figure. If you calculate the unemployment rate using the formula used in the 90’s, as done by John Williams of Shadowstats.com, the unemployment rate is closer to 25%!

9.6 How Well Is the Fed Doing with its Other Responsibilties?

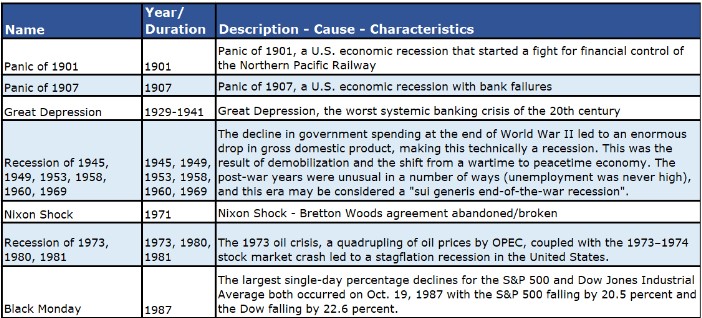

How well is the Fed doing with “maintaining the stability of the financial system and containing systemic risk that may arise in financial markets” and “Supervising and regulating banks and other important financial institutions to ensure the safety and soundness of the nation’s banking and financial system”?

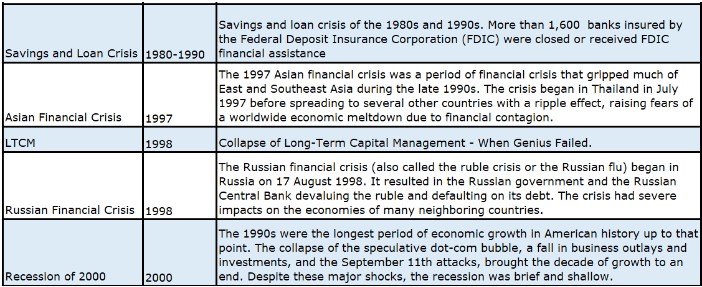

It’s been tough sledding for the Fed. Here’s a brief list of depressions, recessions, banking panics, and financial crises from 1900 to today:

9.7 The Federal Reserve and Monetary Policy

While the Congress and The President are responsible for Fiscal Policy (taxing and spending), the Fed is responsible for conducting monetary policy.

Recall from Unit 8 that the Fed primarily has three tools for conducting monetary policy:

- Reserve Requirements

- Open Market Operations

- Interest Rates

“The Board of Governors of the Federal Reserve System is responsible for the discount rate and reserve requirements, and the Federal Open Market Committee is responsible for open market operations. Using the three tools, the Federal Reserve influences the demand for, and supply of, balances that depository institutions hold at Federal Reserve Banks and in this way alters the federal funds rate. The federal funds rate is the interest rate at which depository institutions lend balances at the Federal Reserve to other depository institutions overnight.

9.8 The Federal Open Market Committee (FOMC)

“The (FOMC) consists of twelve members–the seven members of the Board of Governors of the Federal Reserve System; the president of the Federal Reserve Bank of New York; and four of the remaining eleven Reserve Bank presidents, who serve one-year terms on a rotating basis. The rotating seats are filled from the following four groups of Banks, one Bank president from each group: Boston, Philadelphia, and Richmond; Cleveland and Chicago; Atlanta, St. Louis, and Dallas; and Minneapolis, Kansas City, and San Francisco. Nonvoting Reserve Bank presidents attend the meetings of the Committee, participate in the discussions, and contribute to the Committee’s assessment of the economy and policy options.

The FOMC holds eight regularly scheduled meetings per year. At these meetings, the Committee reviews economic and financial conditions, determines the appropriate stance of monetary policy, and assesses the risks to its long-run goals of price stability and sustainable economic growth.” https://www.federalreserve.gov/monetarypolicy/fomc.htm

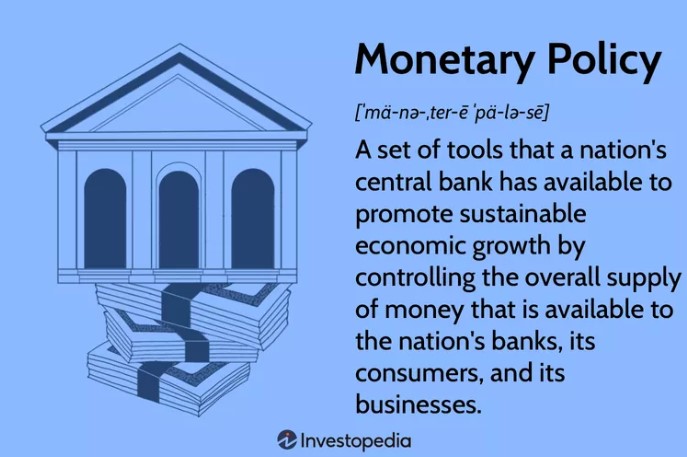

As explained in the previous unit, the FOMC attempts to smooth the ups and downs of the business cycle by manipulating the money supply and interest rates. In times of recession, when the economy is slowing down, the FOMC will recommend an expansionary monetary policy where the Fed buys bonds from banks, which increases the money supply and lowers interest rates for businesses and consumers. Lower interest rates are supposed to stimulate spending. During periods of inflation, when the economy is running too hot, the FOMC will recommend a contractionary monetary policy where the Fed sells bonds to banks, which decreases the money supply and raises interest rates for businesses and consumers. Higher interest rates are supposed to suppress spending. The thought that a committee of academic economists could control the business cycle with any level of accuracy and proficiency may best be described as delusions of grandeur.

Alternatively, a free market economic system is capable of regulating itself.

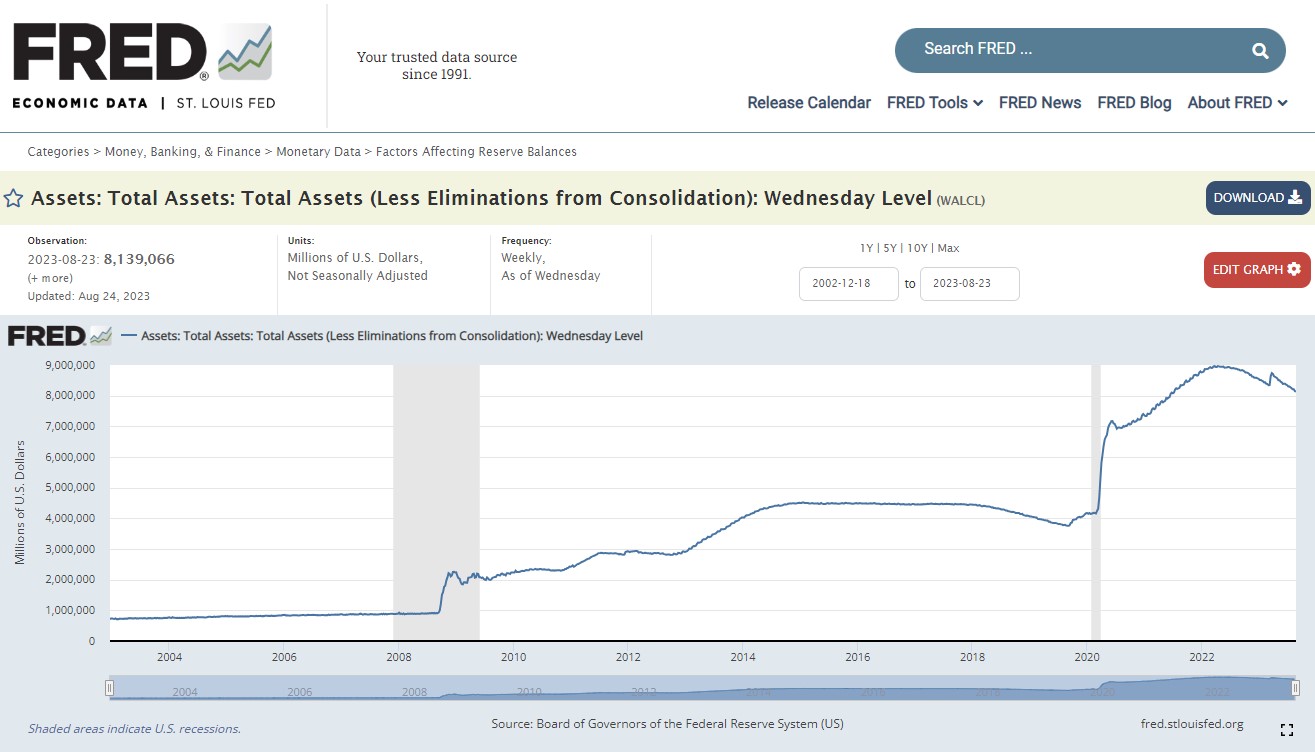

Since the near implosion of the entire global financial system during the global financial crisis of 2008/9, the Fed has had an expansionary, highly accommodative, unprecedented monetary policy stance. As a result, the Fed’s balance sheet has exploded from around $1 Trillion to nearly $9 Trillion!

When the Fed needs dollars to purchase bonds from banks when running an expansionary monetary policy, where does the Fed get dollars? Where did they get 8 Trillion dollars? In the same magic manner that Banks create fiat currency, the Fed can magically create as many dollars as it wants. If it needed 100 Trillion dollars tomorrow, no problem, it can create dollars out of nothing–just like magic. You better believe it!

9.9 Quantitative Tightening

“Quantitative tightening (QT) refers to monetary policies that contract, or reduce, the Fed’s balance sheet. This process is also known as balance sheet normalization. In other words, the Fed (or any central bank) shrinks its monetary reserves by either selling Treasurys (government bonds) or letting them mature and removing them from its cash balances. This removes liquidity, or money, from financial markets.

It is the opposite of quantitative easing (QE), a term that has become ingrained in the financial market’s vernacular since the 2008 financial crisis, which refers to monetary policies adopted by the Fed that expand its balance sheet.”

https://www.investopedia.com/quantitative-tightening-6361478

QT reduces the money supply which increases interest rates, which causes economic pain for consumers, businesses, and the government. As it turns out, there is no free lunch. We will have to experience pain at some point or another.