Unit 8 - The State of Fiat Currency

Learning Objective: Assess the state of fiat currency.

Unit Outline

8.1 The State of Fiat Currency

8.2 The U.S. Treasury

8.3 The The Budget Deficit and the National Debt

8.4 U.S. Debt Clock

8.5 Perpetrators of Fiscal Malfeasance

8.6 Fiscal Policy

8.7 Government Borrowing

8.8 The Cost of Government Borrowing

8.9 Selling Bonds

8.10 Taxation without Representation

8.11 Bondholders

8.12 Deficit Spending – Where Does All the Money Go?

8.13 Defense Spending

8.1 The State of Fiat Currency

With the ability to produce fiat currency magically and without the restraint imposed by real commodity money (that you have to do work to produce), you can probably deduce that the United States of America is in a very sorry state financially.

8.2 The U.S. Treasury

“The U.S. Treasury is a government department in charge of managing all federal finances. It is responsible for collecting taxes, paying bills, and managing currency, government accounts, and public debt. The Department of the Treasury enforces finance and tax laws, as well as issues treasury bonds, considered to be the safest and most liquid securities worldwide.”

(https://www.investopedia.com/terms/u/ustreasury.asp)

The first Secretary of the Treasury was Alexander Hamilton. The current Secretary of the Treasury is Janet Yellen. She previously worked as the Chairman of the Federal Reserve. She was the first woman to hold either position.

How much treasure is in the Treasury? (hint: none, zero, nada.)

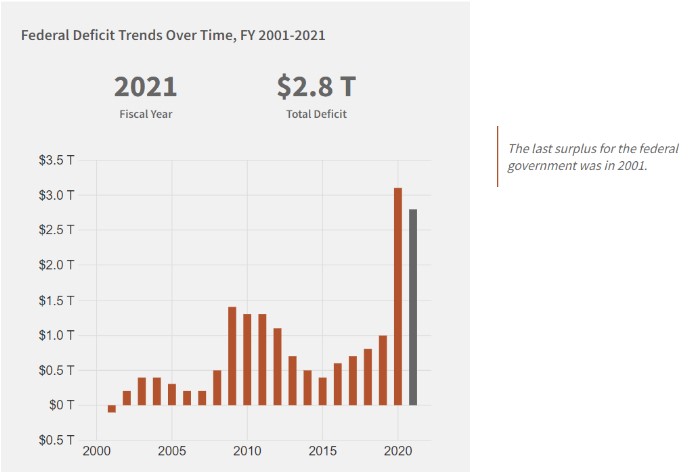

2001 was the last year that there was any money in the Treasury.

8.3 The Budget Deficit and the National Debt

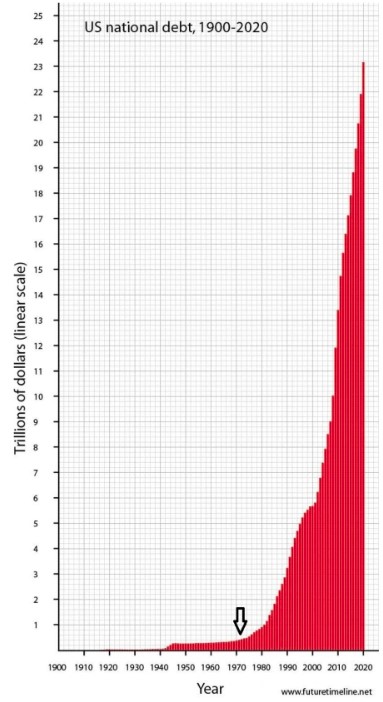

“The terms “deficit” and “debt” are frequently used when discussing the nation’s finances and are often confused with one another.

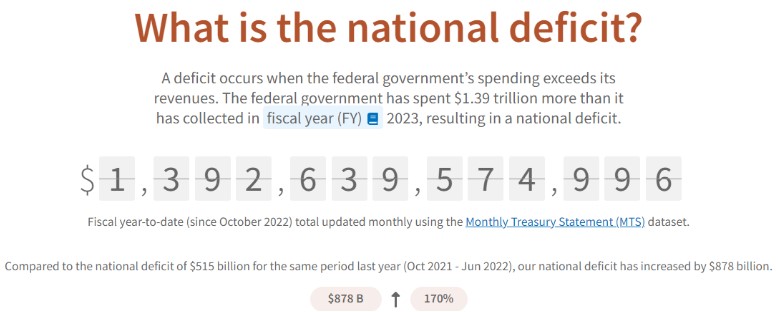

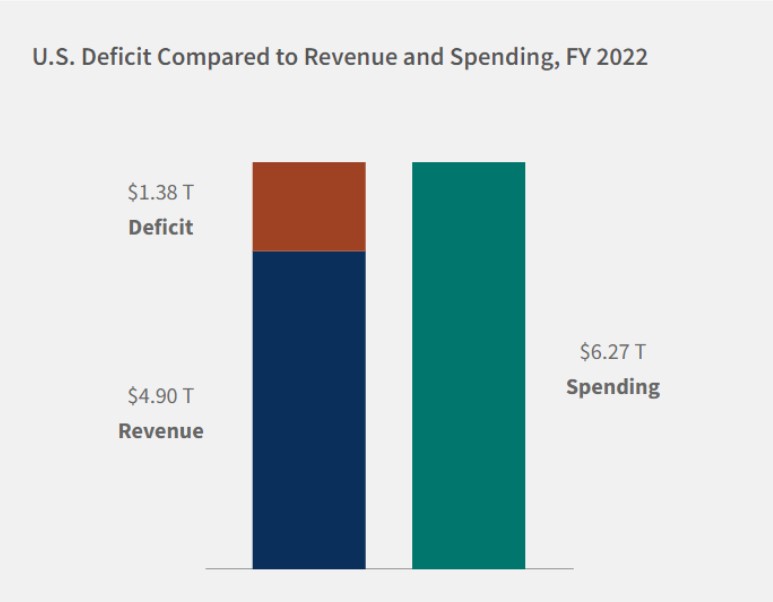

A deficit occurs when the federal government’s annual spending exceeds its annual revenues. The federal government has spent $1.39 trillion more than it has collected in fiscal year (FY) 2023, resulting in a national deficit.

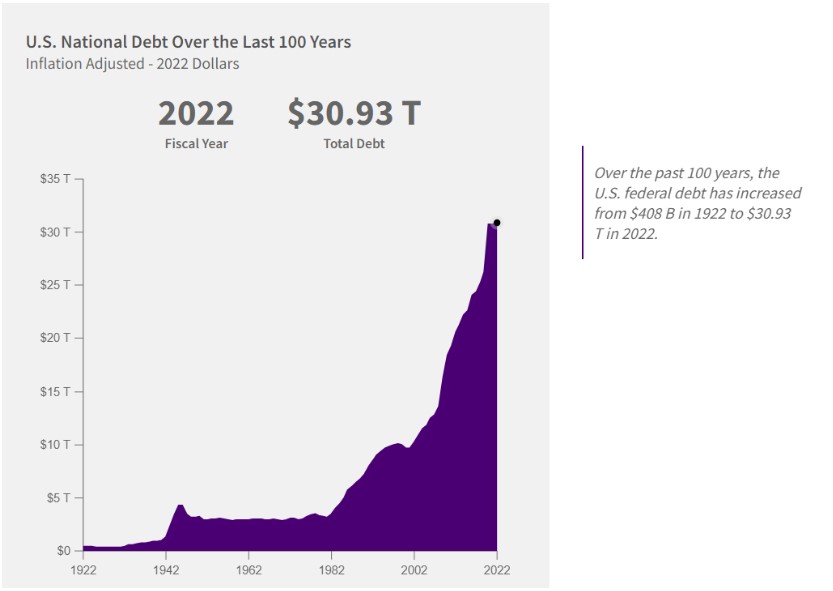

To pay for a deficit, the federal government borrows money by selling Treasury bonds, bills, and other securities. The national debt is the accumulation of this borrowing along with associated interest owed to the investors who purchased these securities. As the federal government experiences reoccurring deficits, which are common, the national debt grows.”

(https://fiscaldata.treasury.gov/national-deficit/)

8.3.1 The Budget Deficit

8.3.2 The National Debt

“In a given fiscal year (FY), when spending (ex. money for roadways) exceeds revenue (ex. money from federal income tax), a budget deficit results. To pay for this deficit, the federal government borrows money by selling marketable securities such as Treasury bonds, bills, notes, floating rate notes, and Treasury inflation-protected securities (TIPS).

The national debt is the accumulation of this borrowing along with associated interest owed to the investors who purchased these securities. As the federal government experiences reoccurring deficits, which is common, the national debt grows.

Simply put, the national debt is similar to a person using a credit card for purchases and not paying off the full balance each month. The cost of purchases exceeding the amount paid off represents a deficit, while accumulated deficits over time represent a person’s overall debt.”

8.4 U.S. Debt Clock

These charts/numbers for the deficit and the debt are for the previous fiscal year 2022, which runs from October 1, 2021 to September 30, 2022. For a real-time look at the state of fiat currency, go to https://www.usdebtclock.org/.

What is the difference between the FY 2022 debt and the real-time debt as shown on the U.S. debt clock website?

According to the U.S. Debt Clock:

- What is the “Debt per Citizen”?

- What is the “Debt per Taxpayer”?

- What will the Debt be in 2027? (Click the “Debt Clock Time Machine” in the top right corner)

8.5 Perpetrators of Fiscal Malfeasance

Who is responsible for the sorry state of our federal finances?

Both the executive and legislative branches of the federal government are involved in the nation’s financial matters. The Treasury department is under the executive branch. “The President has a major role in the country’s fiscal policy. As part of the executive branch, the president lays out plans during the annual budget proposal. This proposal indicates the amount of tax revenue the government intends to collect and how much government spending is anticipated per portfolio, such as education, defense, and health.” https://www.investopedia.com/ask/answers/012715/who-sets-fiscal-policy-president-or-congress.asp

“The Constitution gave the power of the purse – the nation’s checkbook – to Congress. The Founders believed that this separation of powers would protect against monarchy and provide an important check on the executive branch.” https://democrats-budget.house.gov/CPPAct

“Congress has a big role to play in fiscal policy. It is one of the bodies that helps shape the country’s spending and tax policies along with the executive branch. This branch of the government is responsible for developing budget resolutions once the president’s annual budget is approved.” https://www.investopedia.com/ask/answers/012715/who-sets-fiscal-policy-president-or-congress.asp

8.6 Fiscal Policy

“U.S. fiscal policy is largely based on the ideas of British economist John Maynard Keynes (1883-1946). He argued that economic recessions are due to a deficiency in the consumer spending and business investment components of aggregate demand.

Keynes believed that governments could stabilize the business cycle and regulate economic output by adjusting spending and tax policies to make up for the shortfalls of the private sector.

His theories were developed in response to the Great Depression, which defied classical economics’ assumptions that economic swings were self-correcting. Keynes’ ideas were highly influential and led to the New Deal in the U.S., which involved massive spending on public works projects and social welfare programs.” https://www.investopedia.com/terms/f/fiscalpolicy.asp

8.7 Government Borrowing

Since we don’t have any money or currency in the Treasury, the federal government has to borrow currency to fund government spending. They do this by selling Treasury bonds.

“Treasury bonds (T-bonds) are government debt securities issued by the U.S. Federal government that have maturities greater than 20 years. T-bonds earn periodic interest until maturity, at which point the owner is also paid a par amount equal to the principal.

Treasury bonds are part of the larger category of U.S. sovereign debt known collectively as Treasurys, which are typically regarded as virtually risk-free since they are backed by the U.S. government’s ability to tax its citizens.”

(https://www.investopedia.com/terms/t/treasurybond.asp)

8.8 The Cost of Government Borrowing

How much does a Treasury bond pay investors?

If a 30-year U.S. Treasury bond pays a 5% coupon rate, that means the bond will pay $50 per year for every $1,000 in face value (par value) issued. The semiannual coupon payments are half that, or $25 per $1,000. So it costs the federal government $50 per year for 30 years to borrow $1,000. At the end of the term (30 years), the government has to repay the $1,000.

Total Interest: 30 X $50 = $1,500

Total Cost (total interest plus face value (due at bond maturity date)): $1,500 + $1,000 = $2,500

8.9 Selling Bonds

The President proposes a budget. The Congress approves the budget. Inevitably the budget is blown and the government has to borrow currency to pay for the shortage/deficit.

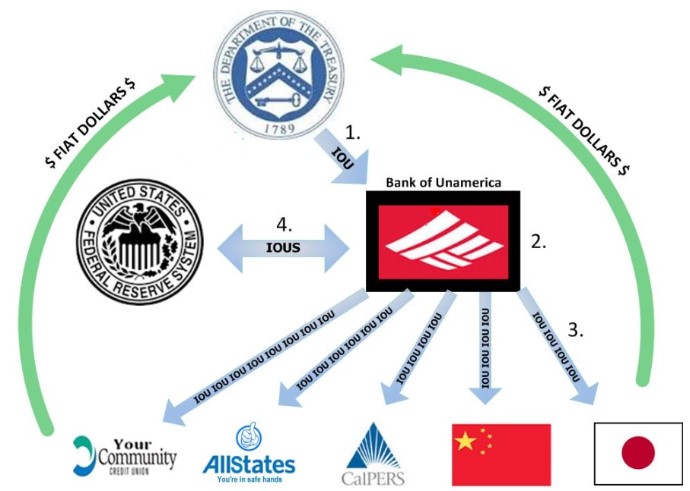

The flow diagram below shows how bonds (IOUs) flow from the Treasury to investors and how fiat dollars flow from investors into the coffers at the Treasury:

- The Treasury issues bonds.

- The Treasury bonds are sold through the biggest Wall Street banks known as primary dealers.

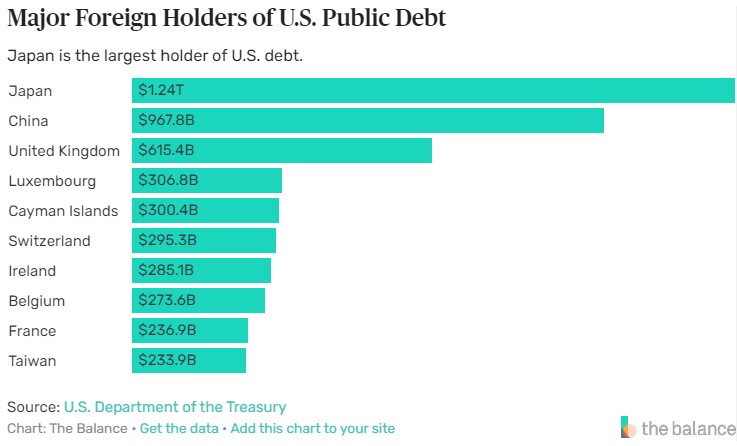

- The Bank of Unamerica buys the treasury bonds and then sells them to various investors. Typical investors of treasury bonds are banks and financial institutions, insurance companies, public employee retirement systems, pension funds, sovereign wealth funds, foreign countries, and any other entity that is seeking a safe, low-risk investment.

- The federal government buys Treasury bonds from the Bank of Unamerica when it wants to increase the money supply or indirectly monetize the debt.

Note that if the “too-big-to-fail” banks (the primary dealers) were to actually fail, as they nearly did during the financial crisis of 2008/9, the transmission of fiscal policy would also fail. After the 2008/9 financial crisis, the too-big-to-fail Wall Street banks were designated as “Systemically Important Financial Institutions” (SIFI). The whole system collapses if the too-big-to-fail SIFIs go down.

Big banks and the federal government have a symbiotic relationship. Who is the host and who is the parasite?

8.10 Taxation without Representation

Racking up huge debts and passing them on to future generations has been likened to fiscal child abuse. This abusive behavior is akin to taxation without representation. The unborn future generations who will inherit our reckless spending don’t get to vote on the debt they are being saddled with. See The Coming Generational Storm: What You Need to Know about America’s Economic Future by Laurence J. Kotlikoff and Scott Burns

https://www.goodreads.com/book/show/295085.The_Coming_Generational_Storm

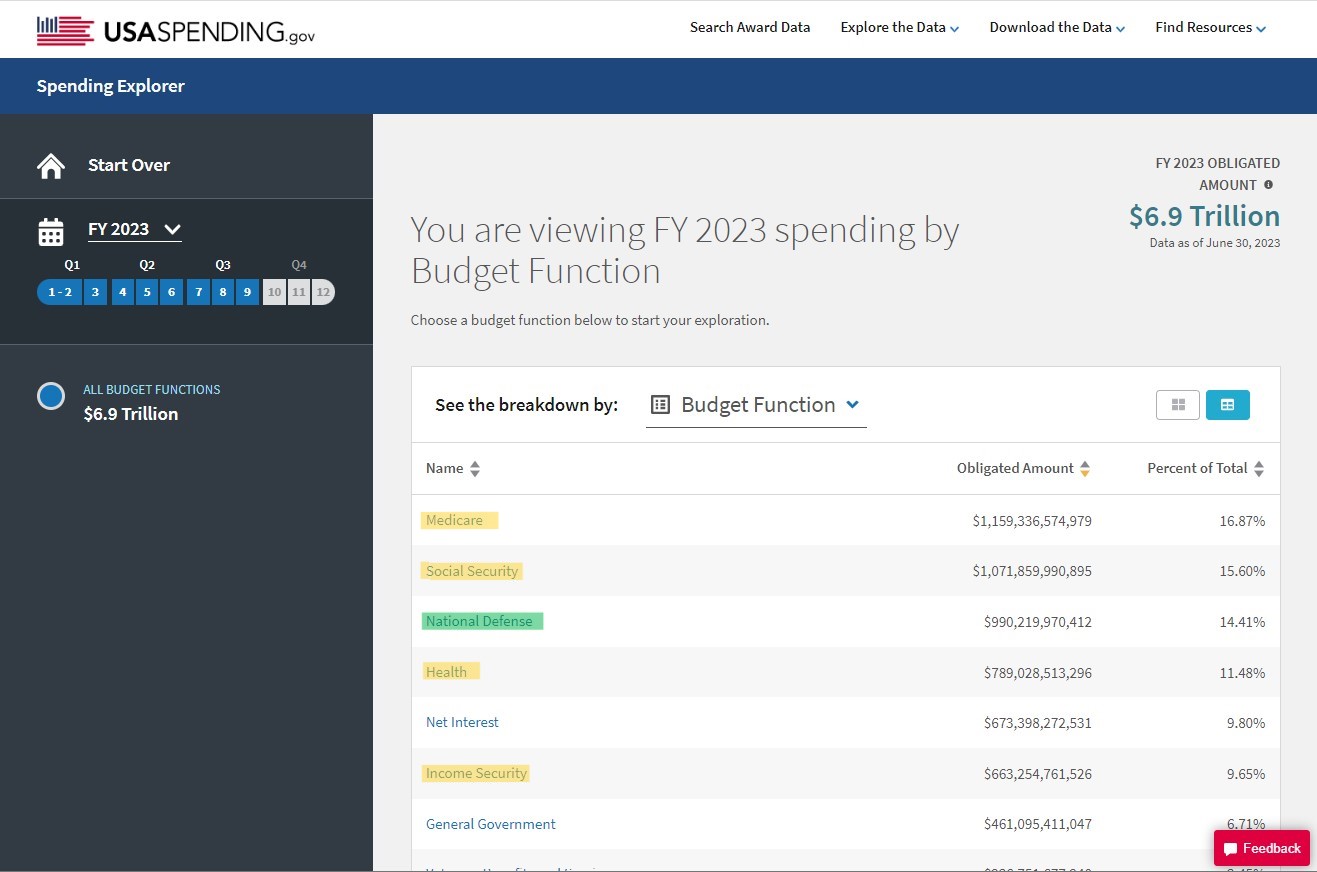

8.12 Deficit Spending – Where Does All the Money Go?

The money goes to the Welfare Warfare State. Over 50% of the $9 Trillion FY 2022 budget went to welfare-related costs. Almost 13% went to warfare. 8% went to pay interest on the debt–a budget category that is rapidly increasing and should be a cause of concern for fiscal hawks (unless they are extinct?).

https://fred.stlouisfed.org/series/A091RC1Q027SBEA

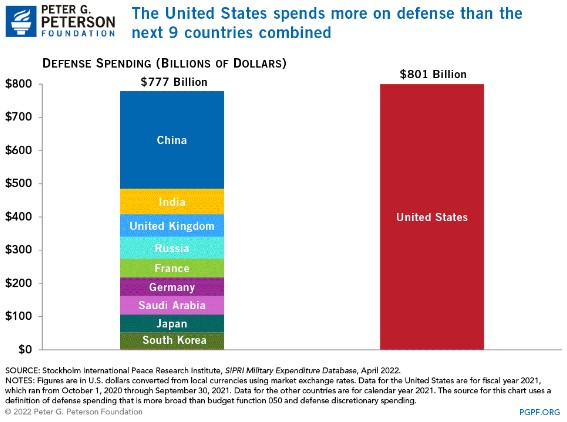

8.13 Defense Spending

The U.S. spends more on national defense/warfare than the next 9 countries combined:

In 1961, during his farewell address, President Dwight D. Eisenhower warned American citizens about the “military-industrial complex”:

“In the councils of government, we must guard against the acquisition of unwarranted influence, whether sought or unsought, by the military-industrial complex. The potential for the disastrous rise of misplaced power exists, and will persist.”

“This conjunction of an immense military establishment and a large arms industry is new in the American experience. . . .Yet we must not fail to comprehend its grave implications.”

“Until the latest of our world conflicts, the United States had no armaments industry. American makers of ploughshares could, with time and as required, make swords as well. But we can no longer risk emergency improvisation of national defense; we have been compelled to create a permanent armaments industry of vast proportions.”

https://www.archives.gov/milestone-documents/president-dwight-d-eisenhowers-farewell-address