Unit 7 - The Supply of Money, Currency, and Cryptocurrency

Learning Objective: Understand and be able to explain who controls the supply of money, currency, and cryptocurrency and how they do it.

7.1 The Supply of Money, Currency, and Cryptocurrency

Who supplies the market with money when money is soft commodity money? Farmers.

Who supplies the market with money when money is hard commodity money? Miners.

Who supplies the market with money when money is cryptocurrency? Miners.

Who supplies the market with currency when the medium of exchange is fiat currency? Politicians and bankers.

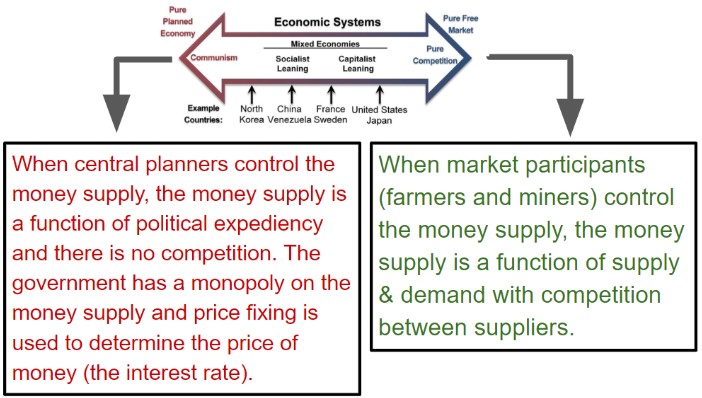

In a free-market economic system, market participants (farmers and miners) supply the market with money. In a centrally planned economic system, the government (politicians) and central planners supply the market with fiat currency. Fiat currency is government currency.

7.1.1 The Supply of Hard Commodity Money

How big is the supply of hard commodity money?

Trying to measure the hard commodity money supply is a bit difficult because we could include any hard commodity–platinum, palladium, lithium, and any other mined commodity. And we should clearly include oil–the commodity that makes mining all the other commodities so much easier. However, for the sake of this exercise, we will just look at the supply of gold and silver–the two most common types of commodity money.

“About 244,000 metric tons of gold has been discovered to date. 187,000 metric tons historically produced plus current underground reserves of 57,000 metric tons. (https://www.usgs.gov/faqs/how-much-gold-has-been-found-world)

“1.74 million metric tons of silver has been discovered to date.” (https://www.usgs.gov/faqs/how-much-silver-has-been-found-world)

There is a finite supply of hard commodity money. The supply is constrained by work.

7.1.2 The Supply of Soft Commodity Money

How big is the supply of soft commodity money?

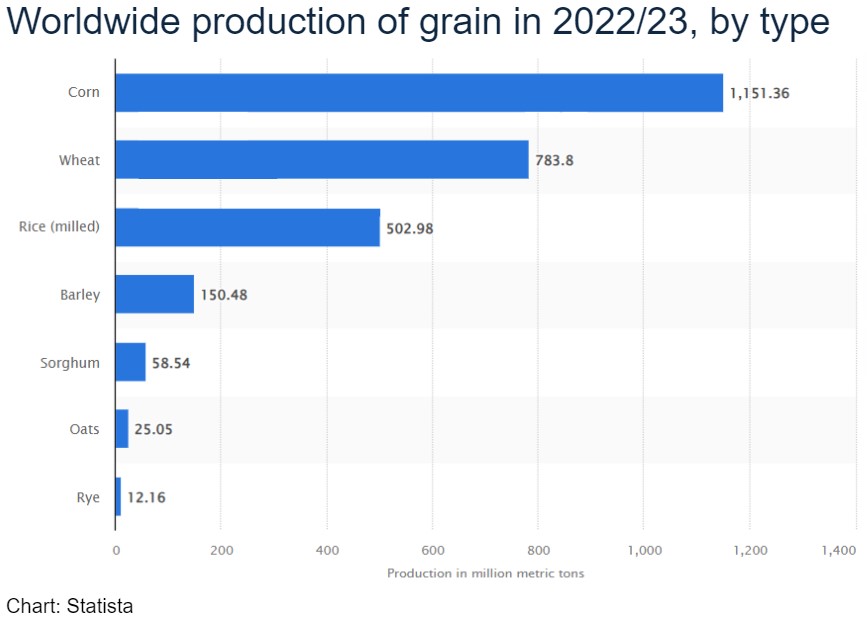

Similar to trying to measure the hard commodity money supply, measuring the soft commodity money size is a bit difficult because we could include any number of soft commodities–buckwheat, rye, quinoa, millet, spelt, and any other grown commodity. For the sake of this exercise, we will just look at the supply of the following grains.

There is a finite supply of soft commodity money. The supply is constrained by work.

7.1.3 The Supply of Cryptocurrency (Bitcoin)

How big is the supply of cryptocurrency (Bitcoin)?

There are 21 million bitcoins that can be mined. 19 million have already been mined.

There is a finite supply of Bitcoin. The supply is constrained by work.

7.1.4 The Supply of Fiat Currency

How big is the supply of fiat currency?

We don’t know. The reserve requirement is 0 (zero) so the money multiplier is 1/0. The supply of fiat currency is mathematically undefined. We don’t know the full repercussions of violating the laws of mathematics but we’re pretty sure the outcome won’t be good. We’re moving into Cloud Cuckoo Land.

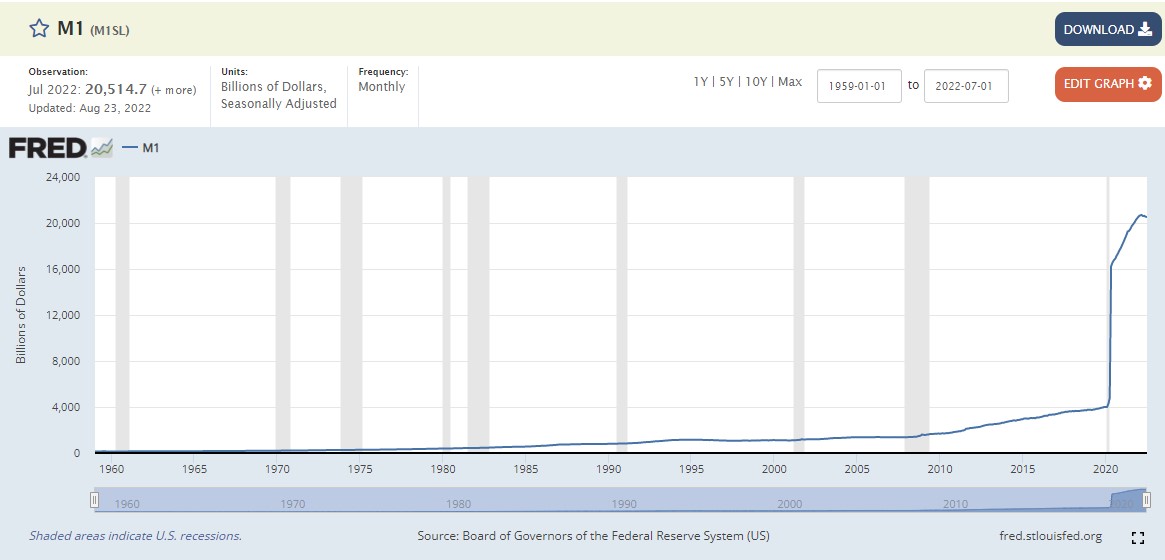

Before we moved into cloud cuckoo land, the Federal Reserve measured the fiat currency supply with two monetary aggregates: M1 and M2.

M1 is a country’s basic fiat currency supply that is used as a medium of exchange. It includes demand deposits and checking accounts. https://www.investopedia.com/terms/m/m1.asp

The M2 aggregate includes all elements of M1 as well as “near money”. Near money refers to savings deposits, money market securities, and other time deposits (in amounts less than $100,000). https://www.investopedia.com/terms/m/m2.asp

Per the chart above, according to FRED, the fiat currency supply is $21.7 trillion.

Despite the fact that the monetary system is undefined, there is an infinite supply of fiat currency and it is definitely not constrained by work. The Federal Reserve and its member banks can magically create as much fiat currency as it wants/needs.

7.2 Controllers of the Money Supply

Who controls the money supply when money is soft commodity money? Farmers.

Who controls the money supply when money is hard commodity money? Miners.

Who controls the money supply when money is cryptocurrency? Miners.

Who controls the currency supply when currency is fiat currency? Polititians and Bankers.

In a free-market economic system, market participants (farmers and miners) control the money supply. In a centrally planned economic system, the state (politicians) and central planners (bankers & economists) control the money supply.

7.2.1 Controllers of the Hard Commodity Money Supply

Mining companies control the supply of hard commodity money. The table below lists the top 5 gold mining companies in the world. (https://investingnews.com/daily/resource-investing/precious-metals-investing/gold-investing/top-gold-mining-companies/#toggle-gdpr)

Barrick Gold is the largest gold mining company in the US. The company’s Carlin mine in Nevada is the largest gold mine in the US. It produced an estimated 1.57 million ounces of gold in 2022.

Locally, Rio Tinto/Kennecott Copper produces approximately 300 thousand tons of copper,

400 thousand ounces of gold, 4 million ounces of silver annually.

The price of gold is set by market forces–supply and demand.

- If supply is high, and demand is high: mining companies may sell their gold at the equilibrium price

- If supply is high, and demand is low: mining companies may store their gold

- If supply is low, and demand is high: mining companies may increase the price of gold

- If supply is low, and demand is low: mining companies may sell their gold at the equilibrium price

Competition between mining companies ensures that the companies operate efficiently in order to offer their product (gold/money) at the best price. Gold is a commodity product and no one company has more chance of controlling its supply and price level than any of its rivals. A commodity product is the same as other products of the same type from other producers or manufacturers. It is impossible to differentiate and brand commodity products. Furthermore, products that have been commoditized do not have any competitive advantages. An ounce of gold is an ounce of gold so successful mining companies need to find innovative ways to produce gold using the least expensive methods and in the most productive manner.

7.2.2 Controllers of the Cryptocurrency Supply

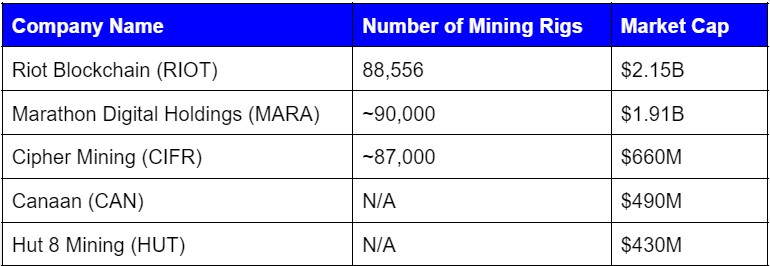

Crypto-mining companies control the supply of cryptocurrency. The table below lists the top 5 crypto-mining companies in the world. (https://capital.com/biggest-global-crypto-bitcoin-mining-companies-ranking-btc)

“Riot’s Rockdale (TX) facility is North America’s largest bitcoin mining facility by developed capacity. It has a total power capacity of 750 MW, with 450 MW currently developed. RIOT produced 2,115 Bitcoin during the three-month period ended March 31, 2023, as compared to 1,405 Bitcoin during the same three-month period in 2022.” See https://www.riotplatforms.com/bitcoin-mining

The price of cryptocurrency/Bitcoin is set by market forces–supply and demand.

- If supply is high, and demand is high: crypto-mining companies may sell their crypto at the equilibrium price

- If supply is high, and demand is low: crypto-mining companies may store/hodl their crypto

- If supply is low, and demand is high: crypto-mining companies may increase the price of crypto

- If supply is low, and demand is low: mining companies may sell their crypto at the equilibrium price

“Bitcoin mining involves solving mathematical equations to process transactions on the blockchain and earn rewards. By doing this, new BTC tokens are created and miners are compensated for their efforts, equipment and electricity bills as they take part in the proof-of-work (PoW) consensus mechanism.

Sophisticated hardware (called a mining rig) is needed to mine bitcoin profitably as the difficulty of the puzzles increases to reduce the speed at which the asset’s supply expands. The largest bitcoin mining companies own thousands of devices that can solve the problems faster than a human. The total value of the BTC they receive in return is considered to be the company’s revenue.

The cost of running large bitcoin mining companies includes the electricity needed to power the devices, maintenance for the mining farms’ expensive cooling systems, personnel and other operating costs typical to any business.” (https://capital.com/biggest-global-crypto-bitcoin-mining-companies-ranking-btc)

Competition between crypto-mining companies ensures that each company operates as efficiently as possible in order to produce their product (crypto/money) at the best price. Crypto is a commodity product and no one company has more of a chance at controlling its supply and price level than any of its rivals. One bitcoin is the same as every other bitcoin so successful mining companies need to find innovative ways to mine crypto using the least expensive methods and in the most productive manner. And anyone can be a crypto-miner. Just buy a mining rig, power it up, and connect it to the Internet.

7.2.3 Controllers of the Fiat Currency Supply

The Federal Reserve (The U.S. Central Bank) controls the supply of fiat currency. They have a monopoly on the issuance of fiat currency.

The price of fiat currency (the interest rate) is not set by market forces–supply and demand–but rather by the economists at the Federal Reserve.

Because The State controls the fiat currency supply, there is no competition between private companies to ensure that each company operates as efficiently as possible in order to produce their product (fiat currency) at the best price. Fiat currency is not a commodity product; only the Federal Reserve controls its supply and price level. Like magic tricks, fiat currency is an illusion. It is a mental construct that market participants accept because they don’t understand the sleight of hand/trickery of the monetary magicians at the Federal Reserve.

7.3 The Federal Reserve and the Fiat Currency Supply

The Federal Reserve primarily has three tools to control the fiat currency supply:

- Reserve Requirements

- Open Market Operations

- Interest Rates

7.3.1 Reserve Requirements

The Federal Reserve rarely changes the reserve requirement for banks. The most recent change was on March 26, 2020 when the board reduced reserve requirement ratios to zero.

What effect on the fiat currency supply would restoring the reserve requirement to 10% have?

(Answer: it would reduce/contract the fiat currency supply. When more fiat currency is chasing the same amount of goods/services, prices generally go up. When less fiat currency is chasing the same amount of goods/services, prices generally go down.)

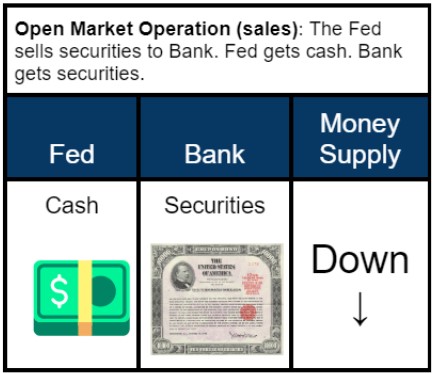

7.3.2 Open Market Operations

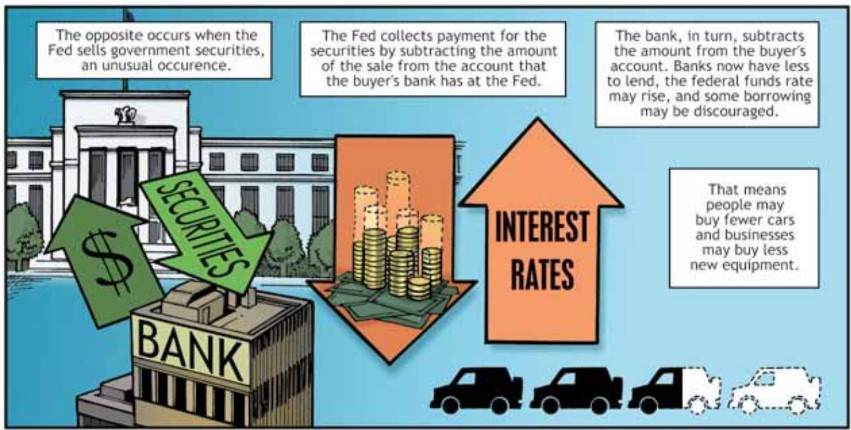

The Federal Reserve regularly conducts Open Market Operations (OMOs). OMOs are “purchases and sales by the Fed of U.S. government securities, which are large IOUs of the federal government. When the Fed buys securities, it pays for them by crediting the amount of the purchase to the account that the seller’s bank has at the Fed. The bank, in turn, credits the seller’s account.

Open market purchases by the Fed provide the banking system with additional [fiat currency] to lend. Open market purchases tend to lower the federal funds rate, the interest rate that banks charge each other on very short-term loans. A drop in the federal funds rate can lead to a decline in the rate that banks charge on loans and pay on deposits.” See pages 6-7 of “The Story of The Federal Reserve System”

“The opposite occurs when the Fed sells government securities, un unusual occurrence…”

7.3.3 Interest Rates

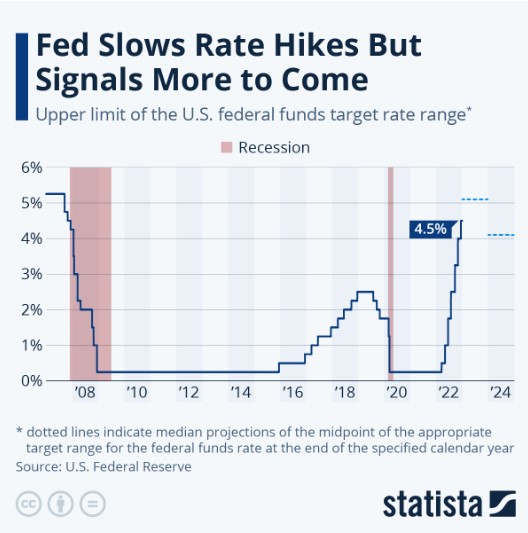

The Federal Reserve regularly changes Interest Rates.

“Interest on reserve balances is just that—interest paid on funds that banks hold in their reserve balance accounts at their Federal Reserve bank. Because interest on reserve balances offers banks a risk-free option, it serves as a “reservation rate”—the lowest rate at which a bank will be willing to lend out its funds. As a result, the federal funds rate should not fall below the interest on reserve balances rate. Because the interest on reserve balances rate is an administered rate, the Fed can steer the federal funds rate by adjusting the interest on reserve balances rate. In fact, interest on reserve balances is the primary tool the Fed uses to adjust the federal funds rate.” https://www.stlouisfed.org/en/in-plain-english/the-fed-implements-monetary-policy

The interest rate is the price of money. If the interest rate is 5% and you want to borrow $100, the price is $5 ($100 x .05). It costs $5 to borrow $100. The price of money/fiat currency is the most important price in the economy. In a free-market economy, that price is determined by market participants. In a centrally planned economy, that price is determined by central planners (bankers & economists) in committee meetings.

From 2009 to 2015 and from 2020 to 2020, the Federal Reserve employed a zero-interest-rate policy (ZIRP). This means that the supplier of fiat currency (The Federal Reserve) supplies the product (fiat currency) to its member banks for free and the banks lend the free money to businesses and consumers for 2, 3, 4%. That’s a pretty good racket.

7.4 Inflation

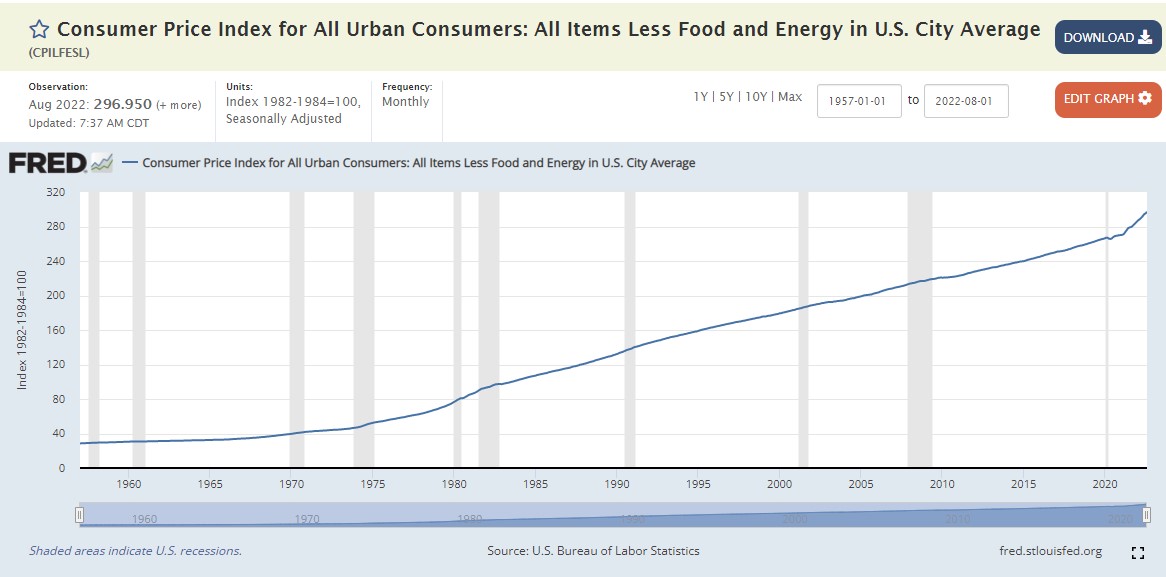

Inflation is an increase in the supply of money or fiat currency. An increase in prices is the result of inflation. Absent an increase in the quantity of goods/services, an increase in the fiat currency supply will result in more fiat currency chasing the same number of goods/services. As a result, prices for goods/services increase.

M1 fiat currency supply experienced an exceptionally sharp increase in 2020, which was the result of the Federal Reserve’s quantitative easing program in response to the COVID-19 pandemic. In May 2020, the M1 money supply was increased from 4.8 to 16.2 trillion U.S. dollars.

Not surprisingly, we have seen significant price increases for goods/services in 2022 and 2023.

7.5 Deflation

In a fractional reserve banking system, deflation is a central bankers worst nightmare. Because of the Ponzi scheme nature of the system, new fiat currency units must continually be created or the whole house of cards will collapse.

See https://www.investopedia.com/articles/investing/051315/what-deflation-and-how-do-central-banks-fight-it.asp

7.6 Measuring Inflation and Price Changes

“The Consumer Price Index (CPI) is a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services.” https://www.bls.gov/cpi/

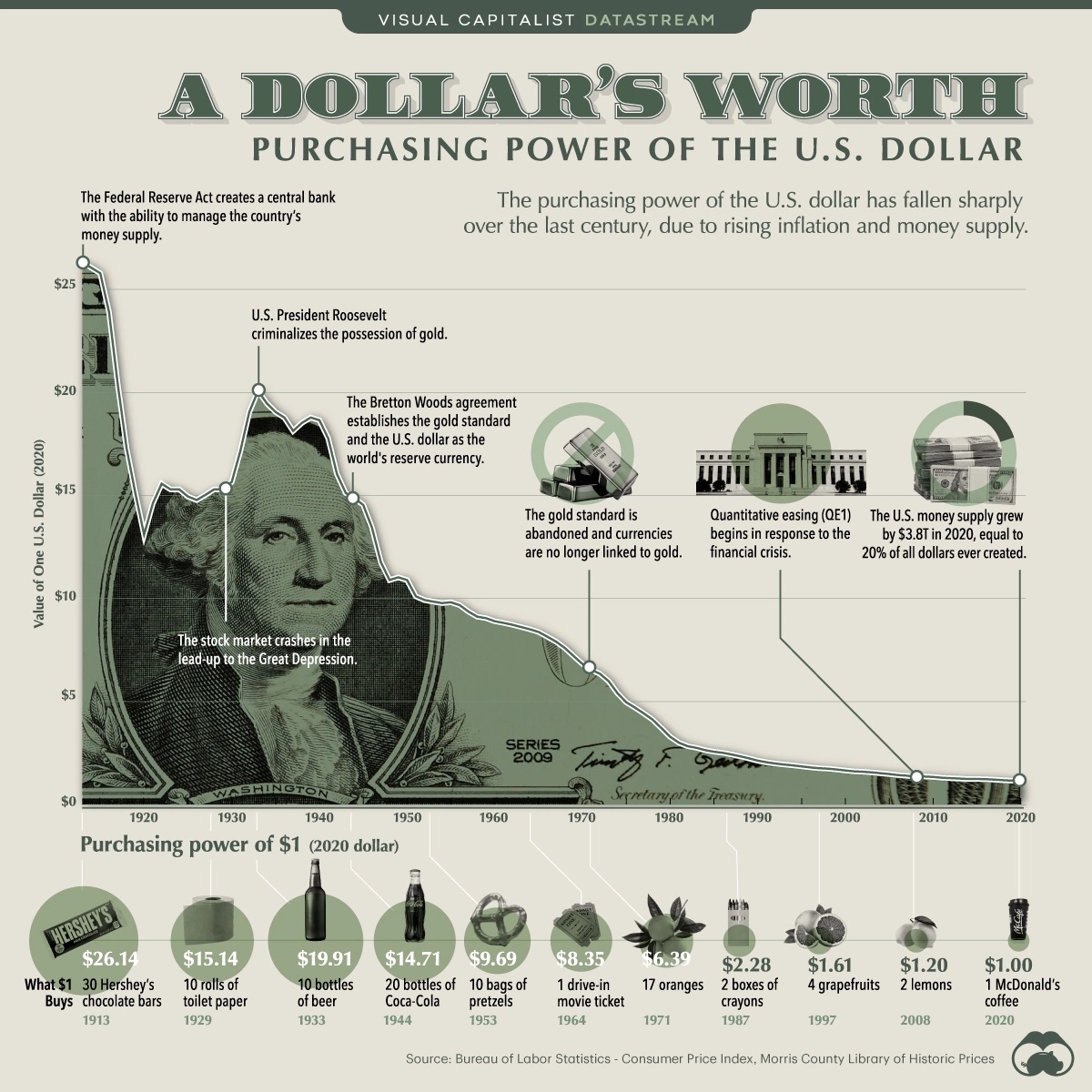

7.7 Purchasing Power of Fiat Currency

Money is a store of value. A store of value is something that retains its value in the future. Does it appear, from the chart below, that fiat currency is a “store of value”?

“The purchasing power of a currency is the amount of goods and services that can be bought with one unit of the currency.”

How much purchasing power has the U.S. Dollar lost since 1913?

Answer: More than 96%

See https://elements.visualcapitalist.com/purchasing-power-of-the-u-s-dollar-over-time/

Summary

Soft and Hard Commodity Money, Representative money, and commodity-backed cryptocurrencies are types of money. Fiat currency is representative money that has been stripped of its commodity backing. Fiat currency circulates like representative money but is really fake representative money. The best type of money is money that functions well as a medium of exchange, a unit of account, a store of value and a measure of value. Commodity money has performed these functions for 5,000+ years. The way forward is backward.

Endnotes

Wikipedia contributors. (2014, November 10). Commodity money. In Wikipedia, The Free Encyclopedia. Retrieved from https://en.wikipedia.org/w/index.php?title=Commodity_money&oldid=925502228

Wikipedia contributors. (2014, June 20). Representative money. In Wikipedia, The Free Encyclopedia. Retrieved from https://en.wikipedia.org/w/index.php?title=Representative_money&oldid=902692859

Wikipedia contributors. (2014, November 15). Fiat money. In Wikipedia, The Free Encyclopedia. Retrieved from https://en.wikipedia.org/w/index.php?title=Fiat_money&oldid=926305692

Wikipedia contributors. (2014, November 19). Swiss franc. In Wikipedia, The Free Encyclopedia. Retrieved from https://en.wikipedia.org/w/index.php?title=Swiss_franc&oldid=926953400 See also https://en.wikipedia.org/wiki/Swiss_franc#cite_note-16

Wikipedia contributors. (2019, September 23). Petrocurrency. In Wikipedia, The Free Encyclopedia. Retrieved from https://en.wikipedia.org/w/index.php?title=Petrocurrency&oldid=917371366

Wikipedia contributors. (2014, November 17). Cryptocurrency. In Wikipedia, The Free Encyclopedia. Retrieved from https://en.wikipedia.org/w/index.php?title=Cryptocurrency&oldid=926662299

Wikipedia contributors. (2014, November 15). Proof of work. In Wikipedia, The Free Encyclopedia. Retrieved from https://en.wikipedia.org/w/index.php?title=Proof_of_work&oldid=926223482

Popper, N. (2016). Digital gold: Bitcoin and the inside story of the misfits and millionaires trying to reinvent money. New York: Harper. See also: https://www.goodreads.com/book/show/23546676-digital-gold

Wikipedia contributors. (2016, November 20). Bitcoin. In Wikipedia, The Free Encyclopedia. Retrieved from https://en.wikipedia.org/w/index.php?title=Bitcoin&oldid=927140927

Wikipedia contributors. (2017, October 26). Stablecoin. In Wikipedia, The Free Encyclopedia. Retrieved from https://en.wikipedia.org/w/index.php?title=Stablecoin&oldid=923190429

“Fiat”. (n.d.). Retrieved from https://www.merriam-webster.com/dictionary/fiat

Wikipedia contributors. (2014, November 15). Currency. In Wikipedia, The Free Encyclopedia. Retrieved from https://en.wikipedia.org/w/index.php?title=Currency&oldid=926293744

Hicks, S. (2014, October 17). Today in Energy. Energy for growing and harvesting crops is a large component of farm operating costs. Retrieved from https://www.eia.gov/todayinenergy/detail.php?id=18431

“Gold supply and demand statistics”. (2014, November 5). Retrieved from https://www.gold.org/goldhub/data/gold-supply-and-demand-statistics

“Cambridge Bitcoin Electricity Consumption Index”. (n.d.). Retrieved from https://www.cbeci.org/

“Bitcoin Energy Consumption Index”. (n.d.). Retrieved from https://digiconomist.net/bitcoin-energy-consumption

“Annual Production Reports”. (n.d.). BUREAU OF ENGRAVING AND PRINTING. U.S. Department of the Treasury. Retrieved from https://www.moneyfactory.gov/resources/productionannual.html

McCook, H. (2014, July 10). Under the Microscope: The Real Costs of a Dollar. Retrieved from https://www.coindesk.com/microscope-real-costs-dollar

Wikipedia contributors. (2014, October 24). Utah Data Center. In Wikipedia, The Free Encyclopedia. Retrieved from https://en.wikipedia.org/w/index.php?title=Utah_Data_Center&oldid=922855008

Buchanan, D. (2013, February 10). “Money Is Gold, and Nothing Else”. Retrieved from https://schiffgold.com/commentaries/money-gold-nothing-else/

Wikipedia contributors. (2014, October 4). Executive Order 6102. In Wikipedia, The Free Encyclopedia. Retrieved from https://en.wikipedia.org/w/index.php?title=Executive_Order_6102&oldid=919512657

Maharrey, M. (2017, August 2). Retrieved from https://tenthamendmentcenter.com/2017/08/02/status-report-states-take-on-the-feds-money-monopoly/

Wikipedia contributors. (2014, November 19). Gresham’s law. In Wikipedia, The Free Encyclopedia. Retrieved from https://en.wikipedia.org/w/index.php?title=Gresham%27s_law&oldid=926970342

Wikipedia contributors. (2019, October 5). The Great Debasement. In Wikipedia, The Free Encyclopedia. Retrieved from https://en.wikipedia.org/w/index.php?title=The_Great_Debasement&oldid=919768767

- Christenson, G. (2016, August 2). You Can’t Eat Gold! Retrieved from https://www.sprottmoney.com/Blog/you-cant-eat-gold-gary-christenson.html