Unit 6 - The Production and Storage of Money, Currency, and Cryptocurrency

Learning Objective: Understand and be able to explain how money, currency, and cryptocurrency are produced and stored.

6.1 The Production of Money, Currency, and Cryptocurrency

To produce soft commodity money, a farmer grows it.

To produce hard commodity money, a miner mines it.

To produce cryptocurrency, a miner mines it.

To produce fiat currency, politicians and bankers make it out of nothing (magically).

6.1.1 How Banks Produce Fiat Currency

You deposit $100 in your bank. Your bank is only required to keep a fraction of the deposit in reserve for you. That is the definition of fractional reserve banking. Instead of 100% of your fiat currency being held in reserve for you, a bank is required to keep only a fraction (1/10 or 10%) of the deposit amount.

6.1.2 Fractional Reserve Banking & The Money Multiplier

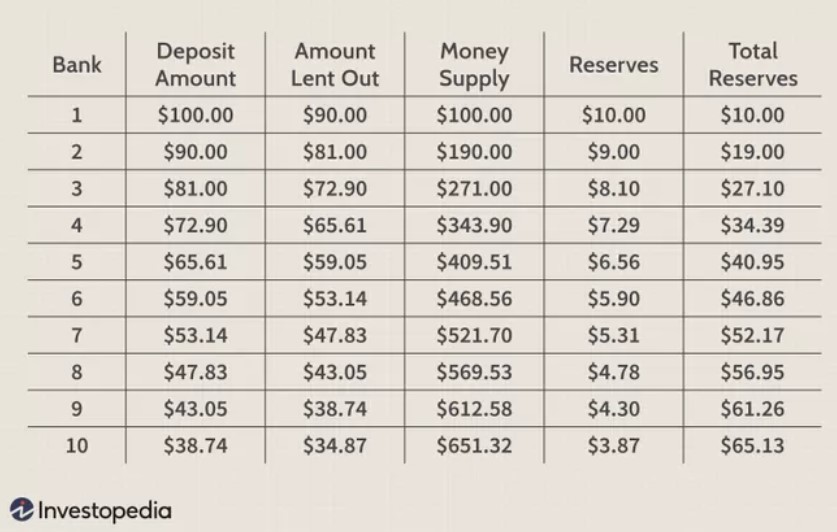

In a fractional reserve banking system, the money multiplier is the amount of new money that is multiplied/created/produced by a bank deposit. If a bank’s reserve requirement is 10%, the money multiplier is 10 and the money supply will eventually be multiplied 10 times the original deposit amount. This means a $100 deposit can be multiplied 10 times so that $100 magically becomes $1,000.

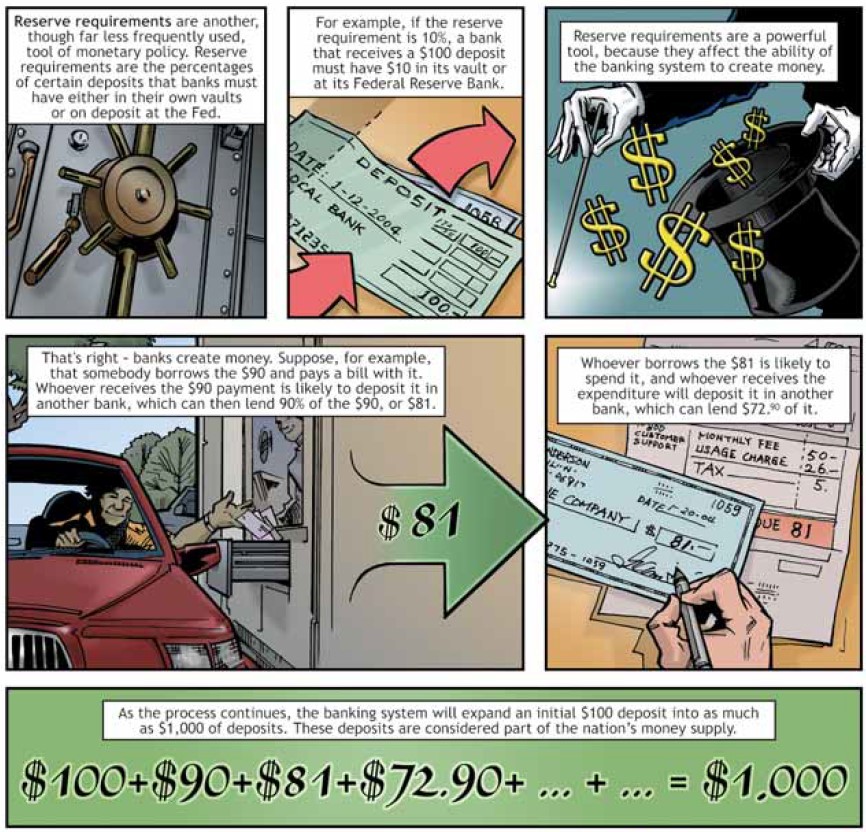

On page 9 of “The Story of The Federal Reserve System” (this is a must-read comic book–no joking), the New York Fed explains how banks magically create money out of nothing:

Furthermore, The Federal Reserve explains how a hundred-dollar deposit can magically turn into $1,000 if deposited and loaned enough times.

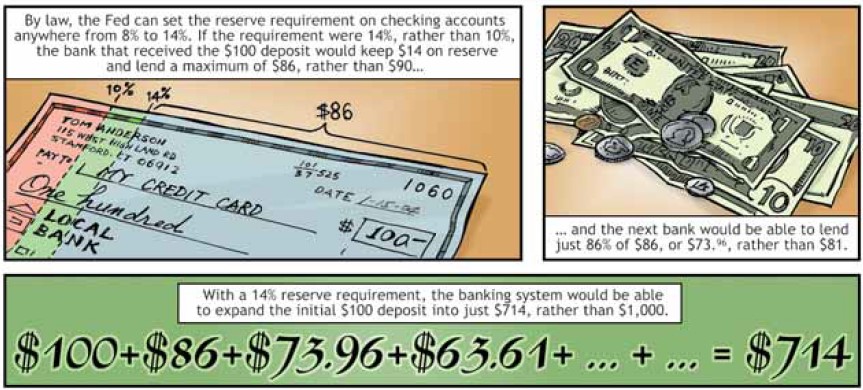

With a 14% reserve requirement, the amount of currency creation is capped at $714 for every $100 deposit.

6.1.3 How to Calculate the Money Multiplier (MM)

MM = 1/RR where RR = Reserve Requirement

If RR is 15%, what is MM?

MM = 1/0.15

MM = 6.6666

Max amount of magic money currency created per $100 deposit: $666

If RR is 5%, what is MM?

MM = 1/0.05

MM = 20

Max amount of magic money currency created per $100 deposit: $2,000

6.1.4 Historical Reserve Requirement Ratio

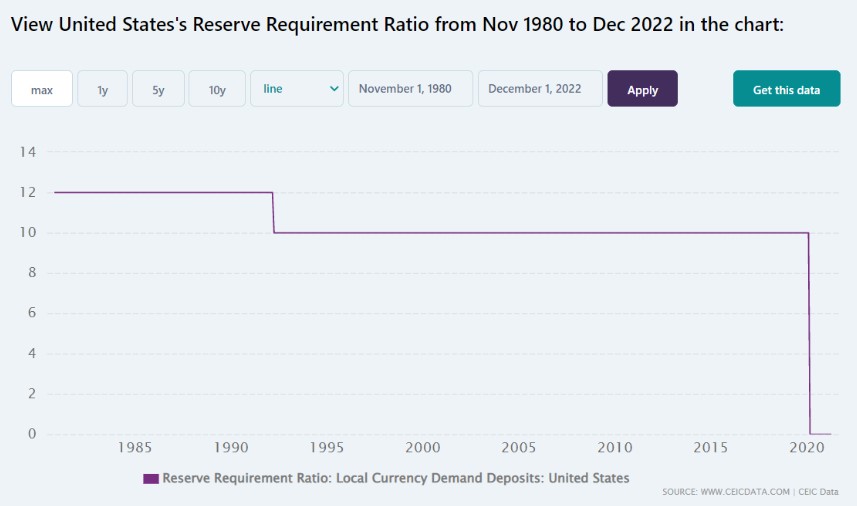

From November 1980 to April 1992, the reserve requirement ratio was 12%. In May 1992, the reserve requirement ratio was lowered to 10% where it stayed until March 2020.

“As announced on March 15, 2020, the [Federal Reserve] Board reduced reserve requirement ratios to zero percent effective March 26, 2020. This action eliminated reserve requirements for all depository institutions.” (https://www.federalreserve.gov/monetarypolicy/reservereq.htm)

Recall the formula to calculate the money multiplier.

MM = 1/RR where RR = Reserve Requirement

If RR is 0%, what is MM?

MM = 1/0

MM = Undefined (what does that even mean?)

An undefined amount of magic money can be created from any amount of bank deposit? Brilliant!

To believe in our monetary system (fractional-reserve banking and fiat currency), you have to believe in magic and not believe in math.

6.2 How Banks Earn Money Fiat Currency

Banks earn money by either lending your fiat currency or lending another bank’s fiat currency.

You deposit $100 in your bank account. The bank pays you 0.01% interest for your deposit. They then loan your $100 to your neighbor at 5-10% interest. Historically (20 years ago), banks would pay depositors 3-4% interest and loan their fiat currency at 7-8%. The spread/difference contributes to the bank’s earnings/revenue/profit.

If a bank doesn’t have sufficient reserves to make a new loan using their depositor’s fiat currency, they can borrow money from another bank at the Federal Funds Rate. In this scenario, your bank loans you $100. The bank charges you 5-10% interest on the loan. They then borrow fiat currency from another bank at the Federal Funds Rate (currently 4.25% to 4.50%). The spread/difference contributes to the bank’s earnings/revenue/profit and although the spread in this scenario isn’t as high as in the first scenario, the bank is still loaning money at higher rates than they are paying.

What is a better return? Which loan makes the bank more money?

Loan 1 – Loaning money at 9% and paying a depositor .01%

Loan 2 – Loaning money at 9% and paying another bank 4.5%

Clearly, it is Loan 1 with net interest of 8.99%

6.3 The Velocity of Money

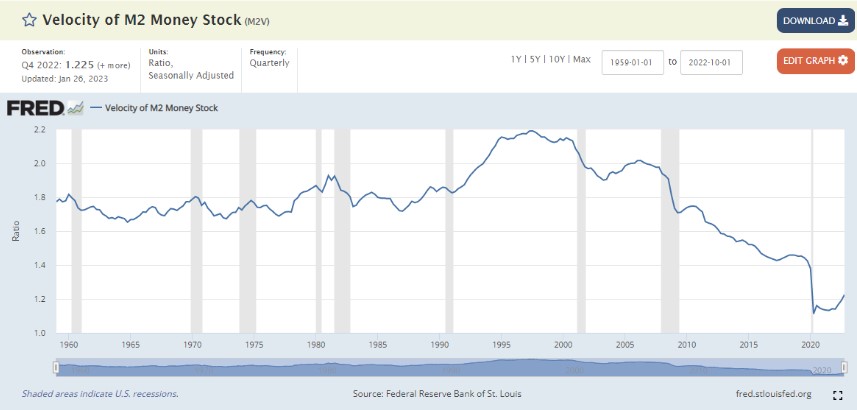

The money multiplier quantifies the amount of money that is created in a fractional reserve banking system. The velocity of fiat currency measures how fast that fiat currency is magically being created. We don’t have to worry about calculating the velocity of money because The Federal Reserve does it for us. The chart below shoes the velocity of M2 money stock (We’ll explain what M2 is in the next lesson). (https://fred.stlouisfed.org/series/M2V).

Shaded areas (gray bars) indicate periods of economic recession. What happens to the velocity of money during a recession? Does this chart seem to indicate that we haven’t come out of the COVID-induced recession?

6.4 Prohibitions Against Multiplying/“Breeding” Money” (aka Usury)

When hard commodity money failed in Egypt, Joseph’s soft commodity money saved the Egyptians from famine. But salvation came at high cost for the upper-class Egyptians who weren’t used to physical work. Joseph essentially owned the Egyptians. If they wanted to eat, they had to work. And they worked for him. When the famine subsided and things went back to “normal”, the Egyptians turned the tables on Joseph and the Israelites by enslaving them. The Israelites worked for the Egyptians–as slaves. Eventually, Moses led the Israelites out of Egypt and into the Promised Land. Before entering Canaan, however, the Israelites were given some rules to live by. One of the rules was a prohibition against charging interest on loans of any type:

Deuteronomy 23:19 Do not charge a fellow Israelite interest, whether on money or food or anything else that may earn interest. 20 You may charge a foreigner interest, but not a fellow Israelite, so that the Lord your God may bless you in everything you put your hand to in the land you are entering to possess. (New International Version)

Anciently, usury was any amount of interest. Today, usury is typically defined as charging an “unreasonably” high rate of interest. Remember, the prohibition against usury for Israelites was for a “fellow Israelite”. That prohibition didn’t apply to “foreigners”.

Usury is also forbidden in Islam. In the Quran (2:275), it says:

But those who take usury will rise up on the Day of Resurrection like someone tormented by Satan’s touch. That is because they say, ‘Trade and usury are the same,’ but God has allowed trade and forbidden usury. Whoever, on receiving God’s warning, stops taking usury may keep his past gains- God will be his judge- but whoever goes back to usury will be an inhabitant of the Fire, there to remain.

“By making riba illegal, Sharia law creates opportunities and contexts in which people are encouraged to act charitably—loaning money without interest.” (https://www.investopedia.com/terms/r/riba.asp)

Philosophers and playwrights also thought poorly of usury. In Dante’s Inferno, userers were eternally tortured in the lowest sub-circle of the seventh circle of hell along with other sinners who did violence against nature and nature’s God. In The Merchant of Venice, the people of Venice despise the Jewish moneylender Shylock who demands a pound of Antonio’s flesh when he defaults on his loan.

If the ancient prophets and philosophers thought usury–charging interest on real money–was a bad idea, I wonder what they would think about usury on fiat currency–charging interest on magic money? Surely Dante is turning over in his grave in Paradiso.

6.5 The Storage of Money, Currency, and Cryptocurrency

If you’re fortunate enough to accumulate surplus money or fiat currency, how and where do you safely and securely store it?

6.5.1 Storage of Soft Commodity Money

Soft commodity money must be stored carefully in a grain silo where it is protected from the elements (sun and water) that could spoil it and from the rodents who would like to consume it.

Ancient Egyptians measured wealth in grain. They built silos and filled them with wheat and barley. The silos were like banks in a way. They were ancient food banks.

Pros and Cons of Storing Soft Commodity Money

- Pros –

- Storing something with intrinsic value

- Sustains life

- Cons –

- Subject to spoilage

- Risk of consumption by rodents/pests

- Requires lots of physical storage space

6.5.2 Storage of Hard Commodity Money

Gold, silver, and other hard commodities can be stored securely at home or remotely in a vault. Anciently, silversmiths and goldsmiths had vaults to store their silver and gold. Banking evolved from an entity providing vaulting services to an entrepreneur who saw other people’s savings as a opportunity to put their money to work by lending it to other people for a fee. To compensate the depositor for the risk of loss, the banker would split the lending fee with the depositor.

Pros and Cons of Storing Hard Commodity Money

- Pros –

- Not subject to spoilage

- No risk of consumption by rodents/pests

- Minimal storage space required

- Cons –

- Minimal intrinsic value

- Doesn’t sustain life (you can’t eat gold)

6.5.3 Storage of Fiat Currency

Fiat currency can be stored at home or in a bank/credit union.

- Home storage pros –

- Fiat currency not deposited in a bank/credit union cannot be multiplied by magicians/bankers into more fiat currency

- Budgeting – required if using the cash envelope budgeting system

- Home storage cons –

- Availability: Must carry with you if you want to buy something

- Risk of loss or theft

- Bank/Credit Union storage pros –

- Convenience: payments are easier with a debit card or mobile pay app

- Access: mobile app and website make tracking expenses and account balances easier

- Insured: If your bank/credit union goes bankrupt, your account is insured up to $250,000

- Bank/Credit Union storage cons –

- Cost/Fees: must be careful not to incur fees

- Depositing your fiat currency in a bank/credit union perpetuates the pyramid scheme inherent in fraction reserve banking

It’s generally a good idea to have some cash on hand but you really need a bank/credit union account to function in our highly financialized society.

6.5.4 Storage of Cryptocurrency

Cryptocurrency is stored in a crypto wallet. A crypto wallet is a hardware device or software program that stores your public and private keys and allows you to send, receive, and spend cryptocurrencies.

“There are two types of storage options for crypto wallets: “hot” storage and “cold” storage. Hot storage is an app or platform that is connected to the internet, while cold storage is stored offline, often through a physical device such as a thumb drive. While both hot and cold storage systems offer individuals access to their [cryptocurrency], they differ in user experience and security levels.

- Hot storage pros –

- User friendly: Because they are always connected to the internet, these platforms allow you to store and access your cryptocurrency easily and from anywhere.

- Cost: Most hot wallets are free to use.

- Convenience: If you are using a hot wallet linked to a particular exchange, it is convenient to interact within that ecosystem.

- Hot storage cons:

- Security: While hot wallets are generally secure, they are connected to the internet and are therefore more vulnerable to being hacked.

- Accessibility: Because they require a connection to the internet, some wallet features may be restricted in certain countries or jurisdictions, depending on local laws.

- Loss or Bankruptcy: If you are using a hot wallet linked to a particular exchange and that exchange goes bankrupt, you may not get all of your cryptocurrency back. See https://thedefiant.io/coinbase-customer-assets-bankruptcy

- Cold storage pros:

- Portability: Cold storage solutions are often small, plug-in devices that can be carried around wherever in the world you go and can easily be used to log into decentralized apps.

- Security: Your private keys never leave the device and transactions are signed locally, making the devices significantly less vulnerable to cyberattacks.

- Autonomy: Cold storage allows you to be the sole custodian of your crypto assets, eliminating third-party applications from your storage experience.

- Cold storage cons:

- Price: Hardware wallets can range between $79 and $255, making them more expensive than online options.

- Transfers: Transfers between cold storage devices are slightly more cumbersome than hot storage wallets.

- Layout: Some people may experience a learning curve on how to use the smaller screens on hardware devices.”

- Loss or Theft: if you lose your hardware wallet or it’s stolen, you lose access to your crypto.

See more at https://www.coindesk.com/learn/hot-vs-cold-crypto-storage-what-are-the-differences/

6.6 Insuring Your Fiat Currency

As mentioned above, all bank/credit union accounts are insured by the Federal Deposit Insurance Corporation (FDIC)/National Credit Union Association (NCUA) for up to $250,000. During the Great Recession of 2008/9, the FDIC raised the insured amount from $100,000 to $250,000; however, due to all the bank bailouts associated with the Great Recession/Financial Crisis, the Deposit Insurance Fund (DIF) used to insure deposits was bankrupted/overdrawn. Fortunately, the Federal government bailed out the FDIC who then bailed out the banks.

6.6.1 Dodd-Frank Act and Future Bailouts

“The Dodd-Frank Wall Street Reform and Consumer Protection Act is legislation that was passed by the U.S. Congress in response to financial industry behavior that led to the financial crisis of 2007–2008. It sought to make the U.S. financial system safer for consumers and taxpayers.” https://www.investopedia.com/terms/d/dodd-frank-financial-regulatory-reform-bill.asp

“In the event of another financial crisis, the lawmakers behind one of America’s largest financial reform bills say the government would not get the political support it needs for a bailout.

Former Connecticut Sen. Chris Dodd and former Massachusetts Rep. Barney Frank — the co-authors of the 2010 Dodd-Frank Act, a law aimed at making banks safer in order to protect consumers and the economy — told Marketplace that legislators wouldn’t agree to save failing financial institutions with taxpayer money as they did back in 2008.

‘Not only politically could you not get away with what we were able to do in 2008, but legally you cannot do it,’ Dodd said.

The Dodd-Frank Act, which President Barack Obama signed into law in 2010, two years after the financial crisis, requires banks to have more capital on hand and limits the risky bets banks can make with their own money.” https://www.marketplace.org/2018/09/19/no-more-bailouts-lawmakers-behind-dodd-frank-say-taxpayers-won-t-foot-bill-next/

6.6.2 2023 Banking Crisis

“Over the course of five days in March 2023, three small- to mid-size U.S. banks failed, triggering a sharp decline in global bank stock prices and swift response by regulators to prevent potential global contagion.” https://en.wikipedia.org/wiki/2023_banking_crisis

Silicon Valley Bank was the largest of the three failed banks. Eighty-nine percent of the bank’s deposit liabilities exceeded the $250,000 maximum insured by the FDIC. Citing systemic risk, the FDIC and the Federal Reserve determined to insure all accounts–even those exceeding the $250,000 limit.