Unit 11 - The Future of Money

Learning Objective: Understand and be able to explain why our current monetary system is unsustainable and what options we have for the future of money.

12.1 The Future of Money

The global financial system is broken. We broke it when we broke the Bretton Woods agreement in 1971. The “Nixon Shock” was supposed to be a temporary suspension of dollar convertibility to gold. Once we realized that we could “get away with it”, the temporary suspension became permanent. But permanence is a very rare thing in economics. The economy is a system and systems are always changing.

12.2 Problems with a Broken Financial System

There are lots of problems with our broken financial system. Two of the largest ones are (1) that the financial system isn’t fair and (2) the imbalances in the system are getting to the point where they will cause the system to fail/collapse/implode if changes aren’t made.

12.2.1 The Financial System isn’t Fair

The rules of the game were changed mid-game. The rules of the game said countries could exchange $35 for 1 ounce of gold. And the golden rule says he who has the gold makes the rules. Countries were exchanging their dollars for gold so rapidly that we were losing our gold and hence our ability to make the rules. So we unilaterally changed the rules and said no more gold for dollars. Now we use military rule. Whoever has the biggest military makes the rules. That’s why we spend more on “Defense” than the next ten countries combined. What are we “defending”? The U.S. dollar. And we do it in part by weaponizing the dollar. If countries don’t do what we say, we’ll cut off their access to dollars and the global financial system.

12.2.2 Consumption without Production Produces Imbalances

We produce dollars and then use those dollars to consume the world’s goods. We essentially get something for nothing. This is good for a while but eventually, a lack of production of real goods in the U.S. means fewer manufacturing jobs, which in turn means higher unemployment. This leads to huge trade deficits and a negative current account deficit. This can only continue for so long before the imbalance is so great that the system implodes.

12.3 Triffin Dilemma/Paradox

This is the gist of the Triffin dilemma–named after the Belgian American, Robert Triffin. He explained why a country’s national currency cannot be used as the international reserve currency and satisfy both the country’s domestic monetary policy needs (stable prices and low inflation) and the monetary policy needs of international countries.

“By ‘agreeing’ to have its currency used as a reserve currency, a country pins its hands behind its back. To keep the global economy chugging along, it may have to inject large amounts of currency into circulation, driving up inflation at home. The more popular the reserve currency is relative to other currencies, the higher its exchange rate and the less competitive domestic exporting industries become. This causes a trade deficit for the currency-issuing country but makes the world happy. If the reserve currency country instead decides to focus on domestic monetary policy by not issuing more currency, then the world becomes unhappy.

Becoming a reserve currency presents countries with a paradox. They want the “interest-free” loan generated by selling currency to foreign governments, and they need to be able to raise capital quickly because of the high demand for reserve currency-denominated bonds. At the same time, they want to be able to use capital and monetary policy to ensure that domestic industries are competitive in the world market and to make sure that the domestic economy is healthy and not running large trade deficits. Unfortunately, both of these ideas—cheap sources of capital and positive trade balances—usually can’t happen at the same time.” https://www.investopedia.com/financial-edge/1011/how-the-triffin-dilemma-affects-currencies.aspx

Under the Bretton Woods gold exchange standard, it was only a matter of time before the U.S. would run out of gold. But under a fiat dollar standard, the U.S. can create as much currency as the world needs, and as long as foreign countries demand dollars and international trade is settled in dollars, the dollar exchange system can continue indefinitely but at the expense of domestic U.S. industry. Our primary export will continue to be U.S. dollars.

12.4 Fixing a Broken Financial System

The world will continue financing our trade deficit, allowing us to buy their produce with our fake money or our trade deficit, along with our other accumulated public and private debts, and it will sink the USS Americana. Eventually, we are going to have to fix our broken financial system–and the sooner, the better.

12.5 Candidates for a New Global Financial System

The top candidates to replace the current monetary system are (1) a supranational digital fiat currency or CBDC, (2) Cryptocurrency (Bitcoin), or (3) Bretton Woods III – the restoration of commodity-backed money.

12.5.1 Supranational Fiat Currency (CBDC)

Proponents of a supranational fiat currency could argue Triffin’s dilemma–that a national currency cannot function both as a national currency and a global reserve currency. So they will propose a supranational fiat currency. Alongside this supranational fiat currency, there could be a global digital fiat currency version that is issued by a global central bank. The Bank for International Settlements (bis.org) is the current global central bank. Perhaps they will issue a global CBDC?

The systemic expansion inherent in a fractional reserve banking system requires new space for the system to continually expand. The system breaks if it stops growing.

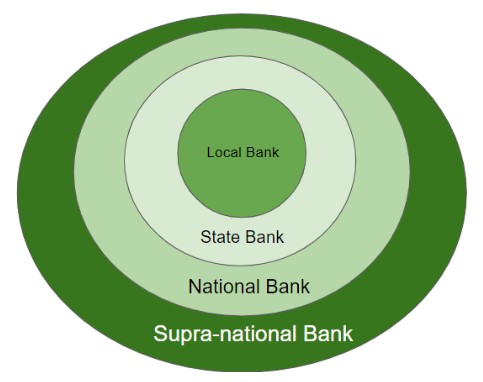

Historically, to prevent local bank runs, the risk pool was enlarged to include state banks. To prevent bank runs at a state level, the risk pool was enlarged to include national banks. Now that nations have run up massive debts, the risk circle needs to be widened to include all banks all over the world united under one global fiat currency regime.

The International Monetary Fund (IMF) would probably like to see its Special Drawing Rights (SDR) used as the successor to the U.S. Dollar and the new supranational fiat currency. According to the IMF, “The SDR—created 50 years ago to supplement IMF member countries’ official reserves—is the only true global money, backed by all IMF members. The IMF’s Articles of Agreement envisioned it as “the principal reserve asset in the international monetary system.” But the SDR has turned out to be one of the most underutilized instruments of international cooperation. A more active use of this tool would significantly strengthen the IMF’s role as the center of the global financial safety net.” https://www.imf.org/en/Publications/fandd/issues/2019/12/future-of-the-IMF-special-drawing-right-SDR-ocampo

12.5.2 Cryptocurrency

Crypto-enthusiasts would love it if Bitcoin or some other cryptocurrency replaced the dollar as the global reserve currency. Apparently, Jack Dorsey thinks this could happen:

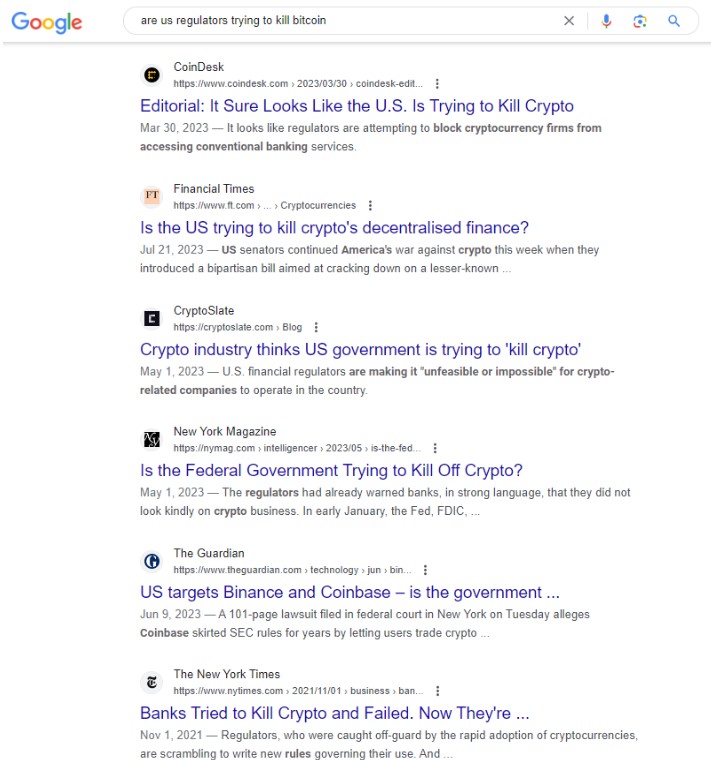

Even if Bitcoin doesn’t replace the dollar, it looks like it is here to stay despite many countries, including China and the U.S., trying to kill it off via regulation:

Remember the money hierarchy from Unit 4:

Cryptocurrency is better than fiat currency but it’s not better than commodity money, representative money (which is backed by a commodity too), or cryptocurrency with commodity backing. That leads us to the next option–a restoration of commodity-backed money, Bretton Woods III.

12.5.3 Bretton Woods III – The Restoration of Commodity-backed Money

In an investor note, Zoltan Pozsar, Former Federal Reserve and U.S. Treasury Department official, and now Credit Suisse Global Head of Short-Term Interest Rate Strategy based in New York, wrote, “We are witnessing the birth of Bretton Woods III – a new world (monetary) order centered around commodity-based currencies in the East that will likely weaken the Eurodollar system and also contribute to inflationary forces in the West.” https://www.credit-suisse.com/about-us-news/en/articles/news-and-expertise/we-are-witnessing-the-birth-of-a-new-world-monetary-order-202203.html

12.5.3.1 Bretton Woods I – The Original Agreement

Date operational: 1944 – 1971

Foreign currencies tied to the dollar and the dollar tied to gold ($35/ounce). Fixed exchange system.

12.5.3.2 Bretton Woods II – The agreement that was broken by the US.

Date operational: 1971 – Today

All currencies fluctuate depending on economic conditions. Floating exchange system.

12.5.3.3 Bretton Woods III – The restoration of the original agreement.

Date operational: ?

Producers require payment in their own national currency bypassing the US Dollar for settlement of international trade.

Examples:

- Russia requires payment in rubles for oil and gas to Europe

- Russia requires payment in rubles for wheat and other soft commodities

- Chinese petroyuan–an alternative to the petrodollar (https://en.wikipedia.org/wiki/Petroyuan)

12.5.4 BRICS Currency

“In August 2023, South Africa hosted the leaders of Brazil, Russia, India, China and South Africa – a group of nations known by the acronym BRICS. Among the items on the agenda is the creation of a new joint BRICS currency.”

“The BRICS countries have been pursuing a wide range of initiatives to decrease their dependence on the dollar. Over the past year, Russia, China, and Brazil have turned to greater use of non-dollar currencies in their cross-border transactions. Iraq, Saudi Arabia, and the United Arab Emirates are actively exploring dollar alternatives. And central banks have sought to shift more of their currency reserves away from the dollar and into gold.” https://fortune.com/2023/06/25/dollar-reserve-currency-brics-brazil-russia-india-china-south-africa/