Unit 10 - The World of Fiat Currency

Learning Objective: Understand and be able to explain the world reserve currency, national fiat currencies, and how countries fight currency wars.

10.1 The World of Fiat Currency

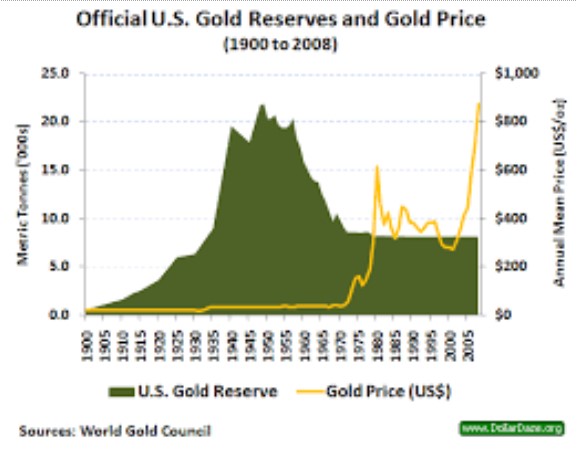

With President Nixon unilaterally breaking the Bretton Woods Agreement on August 15, 1971, there is currently no mutually agreed-upon, rules-based global monetary order. We (the U.S.) changed the rules mid-game so we could keep winning. We were losing our gold reserves (commodity backing for Federal Reserve notes) so rapidly that instead of suspending our spending on wars (Korean War and Vietnam War), bread (Lyndon Johnson’s Great Society social programs), and circuses (wasteful government spending), we suspended the convertibility of the U.S. dollar to gold. At that point, all the world’s representative money turned to fiat currency. A few years later, with Saudi Arabia’s help, we replaced the yellow gold that was backing the U.S. dollar with black gold (oil) backing of the U.S. dollar. The U.S. dollar is now a quasi-fiat currency on account of the implicit backing of oil according to the Petrodollar system that requires oil to be sold in dollars. Furthermore, as the world reserve currency, international trade was and is still settled in dollars. All other national currencies are fully fiat with no commodity backing.

10.2 World Reserve Currency

“A reserve currency is a large quantity of currency maintained by central banks and other major financial institutions to prepare for investments, transactions, and international debt obligations, or to influence their domestic exchange rate. A large percentage of commodities, such as gold and oil, are priced in the reserve currency, causing other countries to hold this currency to pay for these goods.”

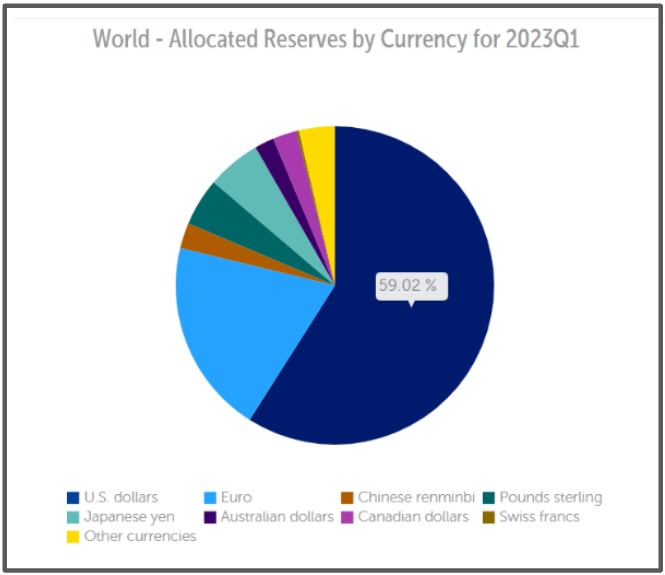

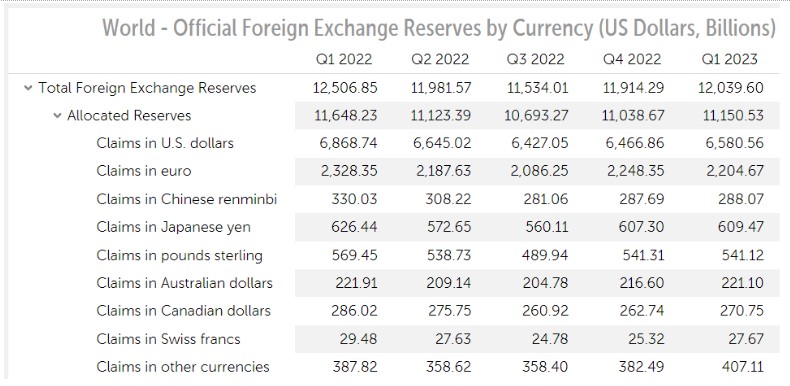

Remember, gold was the world reserve money under the gold standard in the early 1900s. Today, the U.S. dollar represents 59% of global currency reserves:

The next closest currency is the EURO at 20%.

10.3 The Relative Value of Fiat Currencies

With the currency in every country being fiat currency, what is the value of one nation’s currency compared to another? This question can also be asked this way: How many dollars does it take to buy a euro? How many yen does it take to buy a dollar? Etc, etc…

A currency’s value reflects such factors as the size of a country’s economy, growth rate, interest rate levels, and monetary and fiscal policies. These factors vary significantly from country to country and so the value of a currency is expressed in terms of another currency. These two values combined form a currency pair. A currency pair helps equalize factors between two countries by finding a rate of exchange from one currency to another. These exchange rates are very important because they facilitate trade and promote investment between two countries.

How is a currency pair constructed?

A currency pair is constructed using a base and quote currency. Whenever you see a currency pair, the base currency is on the left and the quote currency is on the right. The value of a currency pair, or exchange rate, tells the value of the base currency expressed in terms of the quote currency. Think about it like this: The exchange rate explains how many units of the quote currency it would take to equal one unit of the base currency. The easiest way to understand this is to read the currency pair from left to right. Let’s look at an example.

“Here’s a currency pair involving the euro and U.S. dollar:

EUR/USD

The euro is the base currency and the U.S. dollar is the quote currency. Let’s say that the pair is valued at $1.25. The pair’s value means one euro is equal to one U.S. dollar and 25 cents. The pair itself is what investors buy or sell in the forex market. Even though the pair involves two currencies, it acts as a single item like a stock, bond, or commodity.

A currency pair is traded just like stocks, bonds, and commodities, with bid and ask prices. When buying a currency pair, you pay the ask price. When selling a currency pair, you receive the bid price. The bid/ask spread varies among the different currency pairs. Pairs with the largest bid/ask spreads usually have the least trading activity, while pairs with the smallest trade the most. These active pairs are often referred to as the majors. The majors are the most widely traded pairs. Some of the most commonly traded major currencies are Euro, U.S. Dollar, British Pound, Japanese Yen, Canadian dollar, and Australian dollar. You’ve probably noticed that among the majors, sometimes the U.S. dollar is the quote currency, like with the euro and British pound, and other times it is the base currency, like with the Swiss Franc and Japanese yen. Whether the U.S. dollar is the base or quote currency, just remember that its value is always expressed in terms of the quote currency. Take the yen, for example, which lists the U.S. dollar as the base currency and the yen as the quote currency. Let’s say that the value of the dollar and yen currency pair is 110 yen. This means that one U.S. dollar is equal to 110 yen. Even though it’s expressed in terms of yen, the pair’s actual value equals one unit of the base currency, which is the U.S. dollar.” https://www.youtube.com/watch?v=b0PpzEuCc9A&t=9s

A weaker domestic currency makes exports less expensive and makes imports more expensive. Conversely, a strong domestic currency makes exports more expensive and makes imports less expensive.

10.4 Fiat Currency Purchasing Power Parity (PPP)

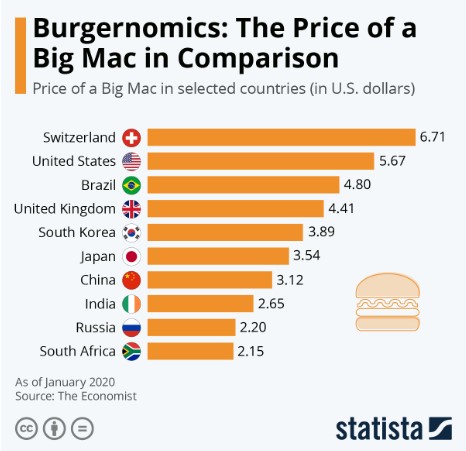

Fiat currency purchasing power parity (PPP) is an economic theory that allows for the comparison of the purchasing power of various world currencies. It is the theoretical exchange rate at which you can buy the same amount of goods and services with another currency. PPP tells you how much things would cost if all countries used the same currency. The theory postulates that the prices of goods and services should equalize among countries over time.

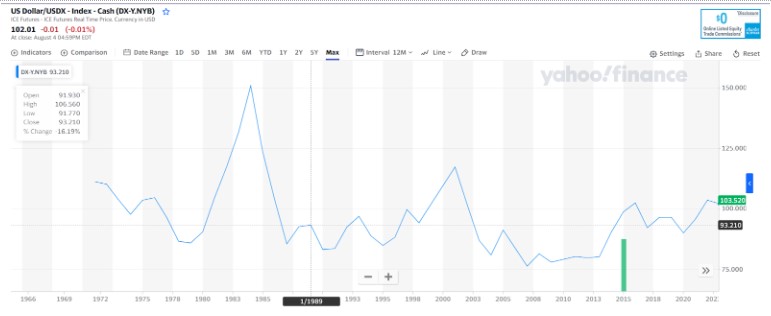

10.5 U.S. Dollar Index (USDX)

The U.S. Dollar Index is used to measure the value of the dollar against a basket of six foreign currencies: the Euro, Swiss franc, Japanese yen, Canadian dollar, British pound, and Swedish krona. The index was established shortly after the Bretton Woods Agreement dissolved in 1973 with a base of 100, and values since then are relative to this base. The value of the index is a fair indication of the dollar’s value in global markets.

10.6 Fiat Currency World Tour

With the crowning of King Dollar at the end of World War II, how would the currencies of countries around the world compete against the King?

10.6.1 Britain’s Pound Sterling (£)

Britain’s pound sterling was the king of currency and the world reserve currency before it was dethroned by the U.S. dollar. While still a respectable currency, the pound has gone from being the top dog, to America’s lap dog. Certainly a source of angst for the Royals but they weren’t humiliated enough by the demotion to join the European Monetary Union (EMU). And while they did join the European Union (EU), they have since BRexited (in January 2020).

The Bank of England (BOE) is Britain’s central bank and manages the pound. As of August 2023, GBP/USD is $1.27

10.6.2 The Eurozone and The Euro (€)

The currencies of the individual countries in Europe were not big enough to effectively compete against the U.S. dollar so in 1992 most of the countries in Europe teamed up to compete against the U.S. dollar. They dropped their national currencies and adopted a common currency–the euro. Countries participating in the European Monetary Union (EMU) include Austria, Belgium, Bulgaria, Croatia, Republic of Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Poland, Portugal, Romania, Slovakia, Slovenia, Spain and Sweden.

These countries all share the same monetary policy but have their own national fiscal policy. Critics claim not having a shared fiscal authority is a problem for EMU-participating countries. https://www.imf.org/en/Blogs/Articles/2018/02/21/the-euro-area-needs-a-fiscal-union

Germany is the economic powerhouse in the EU. Demand for German products (cars, chemicals, and machinery) creates a significant trade surplus for the country. What Germany wasn’t able to do militarily in WWI or WWII, they have done monetarily in 2023–they control all of Europe.

The European Central Bank (ECB) is the Eurozone central bank and manages the euro. As of August 2023, EUR/USD is $1.27

10.6.3 Swiss Franc

Switzerland is noticeably absent from EMU. Staying neutral apparently applies to both military and monetary matters. The country’s neutrality stance, strong rule of law, and privacy guarantees made it a popular banking destination.

The Swiss franc (swissie) had 40% gold backing until 2000. As such it is considered a safe haven asset so in times of economic stress, investors looking for safety will flock to the swissie. During the 2008/9 global financial crisis, the Swiss National Bank pegged the value of the swissie to the Euro at 1.2000 Swiss francs per euro. It defended the peg with open market sales of the swissie to maintain the peg on the forex market.

The Swiss National Bank (SNB) is Switzerland’s central bank and manages the franc. As of August 2023, CHF/USD is $1.14

10.6.4 Russian Ruble (₽)

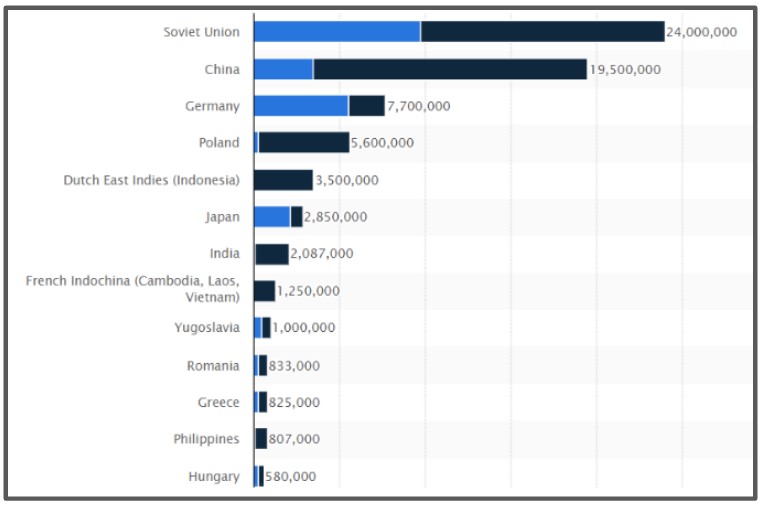

The Soviet Union suffered the most fatalities in WWII. Estimated number of military and civilian fatalities due to the Second World War per country or region between 1939 and 1945

With the country isolated due to its ideological beliefs (communism) and fearing another slaughter of its people, the Soviet Union erected an iron curtain to protect itself from its neighbors to the west. The cold feelings between the East (Russia) and the West (primarily the U.S.) led to an icy relationship between the countries.

The removal of the Iron Curtain and the collapse of the Soviet Union started in 1989 and was partially due to economic stagnation inherent in communist economic systems.

The economy of Russia has gradually transformed from a planned economy into a mixed market-oriented economy. Russia has enormous natural resources, particularly oil and natural gas. It is the world’s eleventh-largest economy by nominal GDP, and the sixth-largest by purchasing power parity (PPP).

The Central Bank of the Russian Federation is Russia’s central bank and manages the ruble. As of August 2023, USD/RUB is ₽100

10.6.5 Japanese Yen (¥)

In contrast to the Soviet Union, after WWII, the U.S. directly helped rebuild Japan.

We sent Dr. W. Edwards Deming to assist the Japanese with rebuilding their manufacturing base. Today Japanese products, including cars and electronics, are regarded as some of the best built products in the world.

The Japanese have used a mercantilist export strategy.

https://www.investopedia.com/terms/m/mercantilism.asp

“U.S. goods and services trade with Japan totaled an estimated $252.2 billion in 2020. Exports were $102.1 billion; imports were $150.1 billion. The U.S. goods and services trade deficit with Japan was $48.0 billion in 2020.

Japan is currently our 4th largest goods trading partner with $183.6 billion in total (two way) goods trade during 2020. Goods exports totaled $64.1 billion; goods imports totaled $119.5 billion. The U.S. goods trade deficit with Japan was $55.4 billion in 2020.

Trade in services with Japan (exports and imports) totaled an estimated $68.6 billion in 2020. Services exports were $38.0 billion; services imports were $30.6 billion. The U.S. services trade surplus with Japan was $7.4 billion in 2020.” https://ustr.gov/countries-regions/japan-korea-apec/japan

The Bank of Japan is Japan’s central bank and manages the yen. As of August 2023, USD/JPY is ¥144

10.6.6 Chinese Yuan (¥)

The Chinese looked across the Sea of Japan and noticed that Japan was getting rich selling their Honda and Toyotas to Americans so they too adopted a mercantilist trade strategy with the U.S. Instead of making high-quality products, China makes low-quality products. They essentially have a conveyor belt from Chinese factories to Walmart.

“The People’s Bank of China (PBOC) allows the yuan to trade in a 2% range around a mid-point it fixes against the dollar each day. That mid-point is based on the yuan’s movement in the previous session and moves in currencies of China’s main trading partners.

China also maintains heavy capital controls, strict foreign investment quotas and a complex system that manages onshore trading and influences offshore yuan activity, leaving the true value of the yuan open to interpretation.” https://www.reuters.com/article/us-usa-trade-china-yuan-explainer/explainer-how-does-china-manage-the-yuan-and-what-is-its-real-value-idUSKCN1UZ0JN

10.7 Currency Wars

“In a currency war, sometimes referred to as competitive devaluation, nations devalue their currencies in order to make their own exports more attractive in markets abroad. By effectively lowering the cost of their exports, the country’s products become more appealing to overseas buyers. At the same time, the devaluation makes imports more expensive to the nation’s own consumers, forcing them to choose home-grown substitutes. This combination of export-led growth and increased domestic demand usually contributes to higher employment and faster economic growth. It may also lower a nation’s productivity. The nation’s businesses may rely on imported equipment and machinery to expand their production. If their own currency is devalued, those imports may become prohibitively expensive.

Economists view currency wars as harmful to the global economy because these back-and-forth actions by nations seeking a competitive advantage could have unforeseen adverse consequences, such as increased protectionism and trade barriers.” https://www.investopedia.com/articles/forex/042015/what-currency-war-how-does-it-work.asp

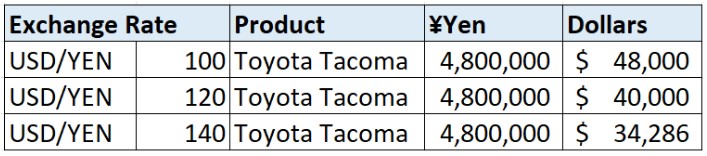

Beggar Thy Neighbor Example – Toyota

Assume Toyota sells its popular Tacoma pickup truck for 4.8M Yen. As the Yen depreciates against the Dollar, Toyota can sell Tacomas at a lower price for the same amount of Yen.

If 1 Dollar will buy 100 Yen, then 48,000 (4,800,000/100) dollars will buy a Tacoma.

If 1 Dollar will buy 120 Yen, then 40,000 (4,800,000/120) dollars will buy a Tacoma.

If 1 Dollar will buy 140 Yen, then 34,286 (4,800,000/140) dollars will buy a Tacoma.

In August of 2018 (5 years ago), USD/JPY was hovering around 110. Today (Aug, 2023), USD/JPY is around 140.

It is feared that currency wars can lead to trade wars that can lead to shooting wars. https://dailyreckoning.com/currency-war-then-trade-war-is-shooting-war-next/

When The U.S. Treasury thinks a country is engaging in competitive devaluation (a polite way of saying a currency war), the treasury will warn the country that they are at risk of facing negative consequences including being labeled as a “currency manipulator”. One example is China. In 2019, The Treasury designated China as a currency manipulator. https://home.treasury.gov/news/press-releases/sm751

Considering that the U.S. is guilty of the biggest currency manipulation of all time when we broke the Bretton Woods agreement, an allegation like this has to be the ultimate example of the pot calling the kettle black!

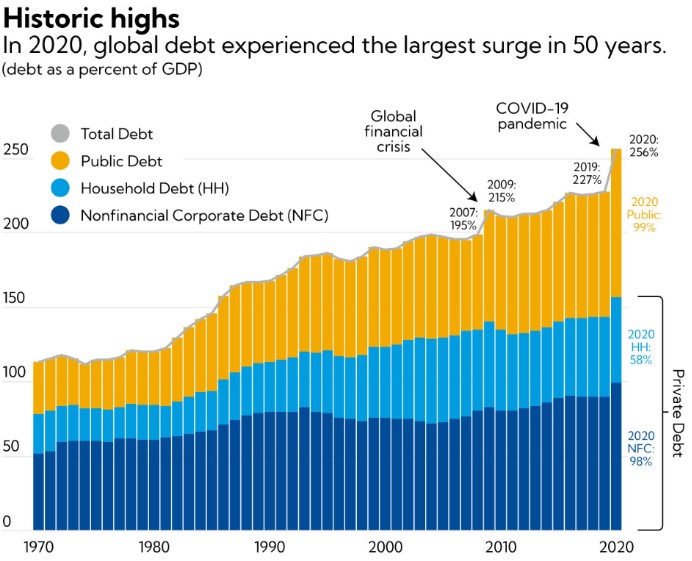

10.8 The World of Debt

Without the constraint of money with commodity backing, countries the world over can create (using magic) as many fiat currency units as they dare (at the risk of being labeled a currency manipulator if they overdo it). As you can imagine, national debts and deficits are, as they are in America, off the charts. The world is in debt up to its eyeballs. “Global debt reached $226 trillion by the end of 2020, seeing the biggest one-year increase since World War II.”

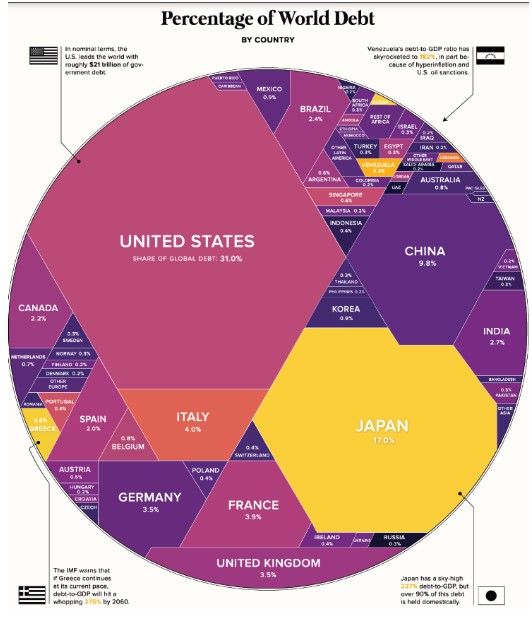

Total Government (public-not HH or NFC) debt by country as of 2018:

See https://www.visualcapitalist.com/69-trillion-of-world-debt-in-one-infographic/

Summary

Soft and hard commodity money, representative money, and commodity-backed cryptocurrencies are types of money. Fiat currency is representative money that has been stripped of its commodity backing. Fiat currency circulates like representative money but is really fake representative money. The best type of money is money that functions well as a medium of exchange, a unit of account, a store of value and a measure of value. Commodity money has performed these functions for 5,000+ years. The way forward is backward.